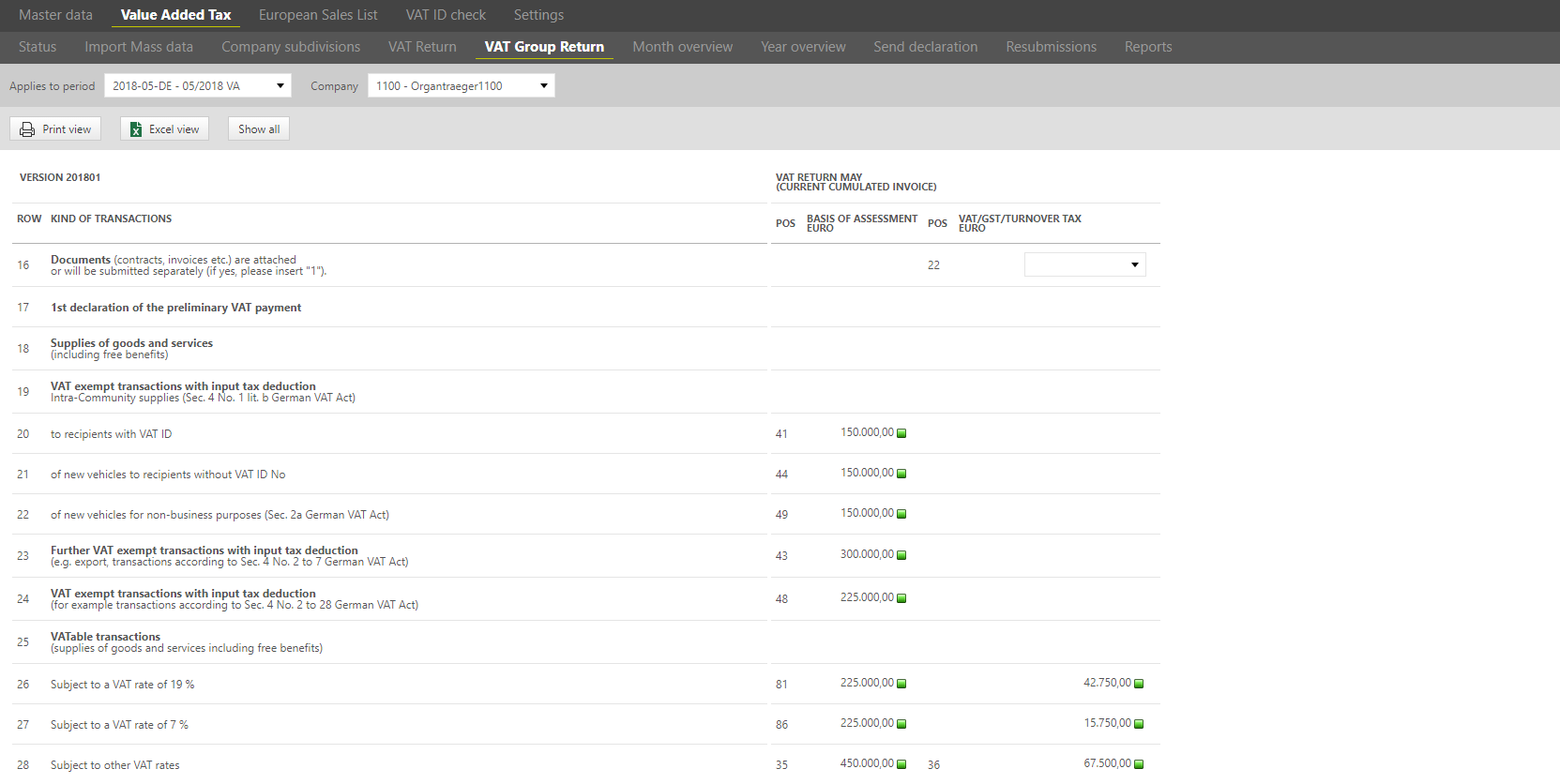

VAT Group Return

The [VAT group return] dialogue depends on the selected period and company, and is only visible for companies that have the [Consolidated VAT group member] or [The representative VAT group member] as a type of VAT group company.

Structurally the dialogue is identical to the [VAT return] dialogue. Depending on the selected period, either the monthly VAT form or the annual VAT return form is shown.

With regards to content, the individual field positions consist of the company reporting data (as well as all subordinate companies), provided they have already finalised their VAT return for the current period. It is irrelevant for the VAT group return whether the member of the VAT group has filled its VAT return manually or by means of data import.

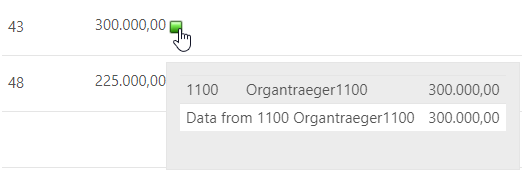

If a [green box] appears beside the amount in the field, it means that the values are transferred to the VAT group from a certain company.

On mouseover the user can view the detailed information, the company which is the data source. However, only the direct level is visible. If a [grey box] appears beside the amount in the field, it means that no entries have been found in the members of the VAT group. The reported amount for such fields is always EUR 0.00. No adjustments are possible in this dialogue, since the changes would be always company-specific. Therefore, if the changes must be made before finalising the VAT return, open the VAT return of the corresponding company and make the required changes there.

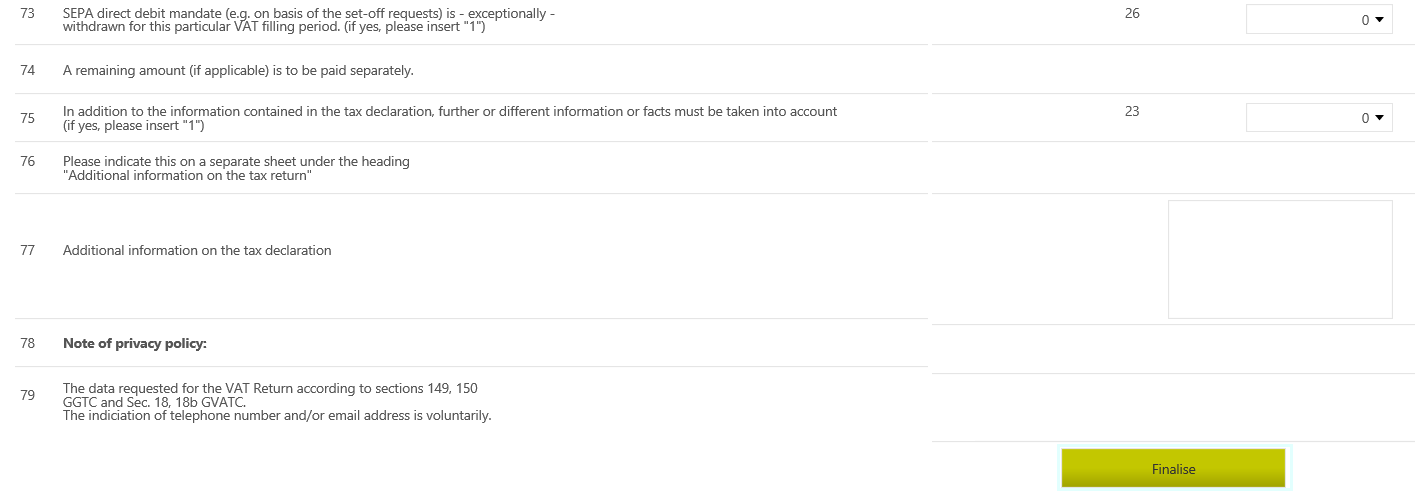

Only after the VAT returns of all VAT group members have been closed, the VAT group return can be finalised.

If the selected company is a [consolidated VAT group member], the VAT intermediate group return is transmitted to the parent company (representative VAT group member or consolidated VAT group member) and transferred to the [VAT group return].

If the selected company is a [representative VAT group member], it is possible to submit the VAT return to the tax office.