Special prepayment

According to section 46 UStDV (Value Added Tax Ordinance), the tax office has to extend the deadline for the submission of preliminary VAT returns and prepayments by one month upon entrepreneur’s request. As a rule, the application must be submitted in accordance with the official data record by remote data transmission. To benefit from this so-called permanent extension of the filing deadline, the entrepreneur has to make a special prepayment to the tax office in accordance with section 47 UStDV (Value Added Tax Ordinance). The special prepayment is one-eleventh of the sum of the prepayments for the previous calendar year and has to be calculated, reported and paid by the statutory date of submission of the first preliminary VAT return. If, for example, a reporting party applies for a permanent extension of the filing deadline, it is entitled to submit the VAT return one month later, to submit the VAT return for January 2017 on 10.03.2017 instead of 10.02.2017. If it applies for a permanent extension of the filing deadline for the year 2017, the request has to be submitted by 10.02.2017 and at the same time the special prepayment has to be made available to the tax office.

The calculation of the special prepayment is a time-consuming process, especially for companies with a large number of VAT group members. In addition, the calculation becomes even more complicated if the company performed or started a professional or commercial activity during a part of the previous calendar year. The VAT@GTC offers the possibility to calculate the special prepayment automatically. To do so, it is necessary to create a special prepayment period in the [Periods] dialogue of the master data area.

If the application for a permanent extension of the filing deadline has been approved by the tax office, the company is entitled to submit its VAT returns one month later. In accordance with section 48 UStDV (Value Added Tax Ordinance), the special prepayment amount paid by the entrepreneur to the tax office before the application has to be taken into account when determining the prepayment for the last VAT return period of the tax period to which the extension applies. This means that a fixed special prepayment (as a rule) will be charged in the monthly VAT return for December. This process is performed automatically by the VAT@GTC.

Status

If a special prepayment period is selected in the [Status] dialogue of the [VAT] area, the view and basic dialogue functions differ from those of the VAT periods.

To send a special prepayment it is important to indicate the tax number of the company in the [Company] dialogue.

Good to know!

When creating a special prepayment period, it is necessary to select a copy period regarding the master data. Ideally, this should be the closed December - VA period. The stored companies are not copied from this period. The VAT@GTC automatically checks the entire year, which companies have passed, and considers them for the special prepayment period (especially important, if companies belonged to the VAT group for a period of less than a year).

As with a monthly/quarterly VAT return period, the status reflects the steps from the creation of the VAT return to its submission to the tax office. These steps are explained in more detail in the following chapters.

Declaration

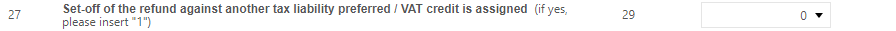

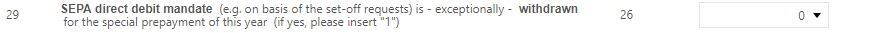

This dialogue shows the special prepayment form. It is especially important to select the corresponding company. To offset the special prepayment amount (e.g. with a refund amount from a previous month) or if the refund amount has been assigned, a 1 has to be entered in field 29 of the VAT@GTC form.

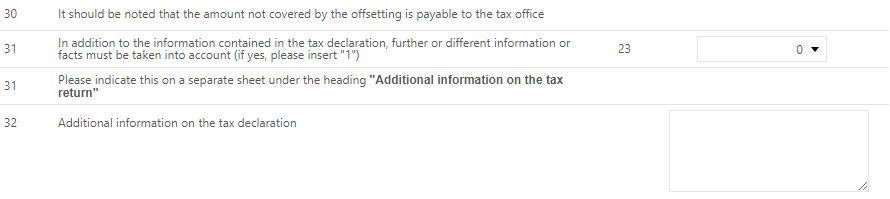

It should be noted that the amount not covered by the offsetting is payable to the tax office. It is possible to cancel the granted SEPA Direct Debit Mandate to the tax office for the special prepayment. In this case enter 1 in field 26 of the VAT@GTC form.

If a taxpayer wants to make further statements or deviating statements from those in the tax return, or if any further facts have to be clarified, a 1 has to be entered in field 23 of the VAT@GTC form. Moreover, these additional explanations have to be stated on a separate form. Please fill out the free description field in the VAT@GTC.

Manual filling of the special prepayment

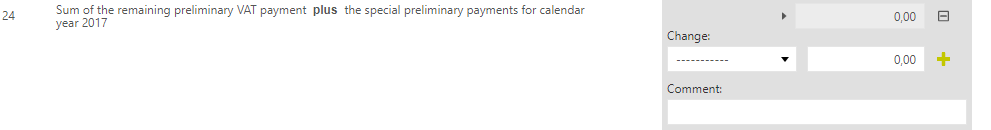

The amount can be entered manually in line 24 of the VAT@GTC form. This can be done, for example, if the previous year has not yet been created in the VAT@GTC.

A manual entry requires a meaningful comment. If the entry is confirmed by the [Plus sign ], the amount to be paid to the tax office will be calculated automatically. Please mind selecting the shortest reporting period in the form. If [Quarter] is selected, the VAT@GTC sets the amount to be paid to 0. - €, regardless of the total.

Automatic calculation by the VAT@GTC

The form can be filled automatically by clicking the [Import SVZ values] button. The following will happen in the background:

Now the system carries out the calculation of the special prepayment (displayed in line 25)

- If the company is a quarterly payer, the payment is automatically 0. - €

- If the total of the tax payable/refunds results in a refund, the payment is 0. - €

- If the company did not hold the full 12 months, the system increases the existing amounts to the sum for the entire year and divides it by 11 for a monthly payer

Good to know

Only preliminary declaration values from closed or sent declarations are transferred to the SVZ period. If a preliminary declaration has not yet been completed, there is a corresponding warning message after the transfer that this data has not been transferred.

If the SPP period is a productive period, all data is also transferred from productive periods. If the SPP period is a test period, only data from any existing test periods is imported.

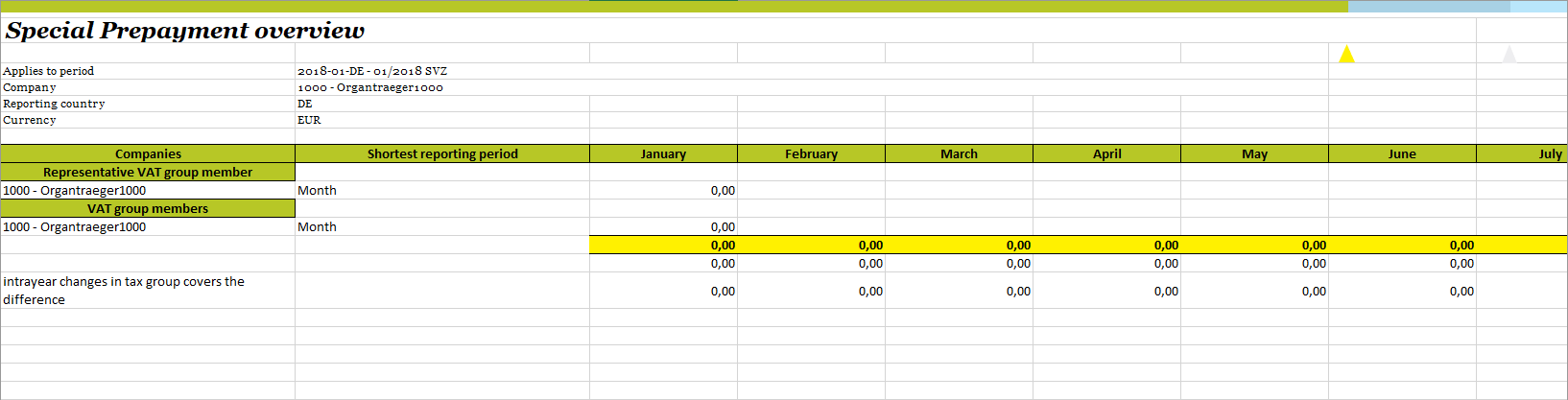

Overview special prepayment

This overview dialogue provides an overview of the status of the special prepayment form for the selected period. If the selected company is a representative VAT group member, the members of the VAT group will also be shown in the overview.

If the special prepayment is still in progress, the [Yellow] milestone is displayed. To close the milestone, click on the [Milestone] and the status changes to [Green].

If the milestone is already closed and marked green, click on this milestone to open the special prepayment again .

If the VAT return has already been sent to the tax office, it cannot be changed anymore. Though, a corrected VAT return can be created and sent to the tax office. The milestone than contains a number [], which indicates the number of corrected VAT returns.

Good to know

When the monthly VAT return for December in the following year is created, the value of the special prepayment is automatically transferred to the special prepayment field. To do this, the special advance payment period must be a productive period and the return must be closed.

Send declaration

This dialogue allows the user to send the VAT return to the tax office. It functions in the similar way as the [Send VAT return] dialogue. Thus, it enables the user to either print out the VAT return or send it directly to the tax office. In case of electronical filing, there is a possibility to send the special prepayment in advance in a test case.

Special prepayment report

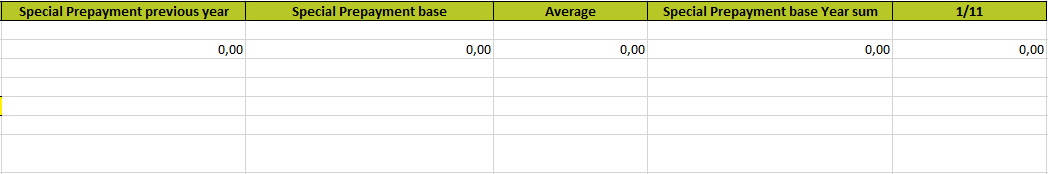

The report [SVZ-Overview] is displayed in the [Report] dialogue, when a special prepayment period is selected in the [VAT] dialogue.

In addition, the user also gets an overview of the special prepayment of the previous year, the average and the calculated 1/11 in this report. The standalone companies are displayed in a separate worksheet in the report.

Good to know!

Only when the [Enable processing] is activated in Excel, the totals in the lower rows can be calculated.