European Sales List

The European Sales Listing (ESL) was introduced to secure the tax revenue of the individual member states of the European Union. It serves to monitor deliveries and other services within the European internal market. The information that has to be included in the ESL for Germany is described in section 18a (7) UStG (Value Added Tax Act).

According to section 18a (1) of the UStG (Value Added Tax Act), the entrepreneur has to submit a ESL to the Federal Central Tax Office for each calendar month in which they have carried out intra-community supplies of goods and/or deliveries according to the section 25b (2) (simplified triangulations). This must be done by the 25th day of the following month (that is, the January ESL must be received by 25th February). A permanent extension of the filing deadline for the ESL is not possible.

Deadlines may differ. The following deadlines apply:

- Quarterly submission:

If the sum of the tax base for intra-community deliveries and triangular transactions in any of the previous four quarters was higher than 50,000 € and does not exceed the limit of 50,000 € in the current quarter, the ESL may be submitted quarterly. In this case it has to be sent by the 25th day after the end of the quarter (i.e. 1st quarter = 25.04, 2nd quarter = 25.07, 3rd quarter = 25.10 and 4th quarter = 25.01.). If the ESLs need to be submitted on a monthly basis, this should be indicated in the corresponding field in the first monthly declaration.

Please note: if the threshold of 50,000 € is exceeded within one quarter, the ESL must be prepared monthly from this point in time, and for all months of the current quarter. The ESL must then be sent by the 25th day after the end of the month in which the threshold was exceeded. The reporting party can choose between two variants. The ESL may either contain all values of the current quarter, including the previous month or the two previous months. However, it is also possible to submit a separate monthly declaration for each individual month of this quarter.

If the threshold of 50,000 € is exceeded, for example, in February, a ESL must be sent to the Federal Central Tax Office by March, 25. Alternatively, ESLs may be sent separately for January and February, or one ESL for both months together, listing the totals of the tax bases for January and February.

- Annual submission

In case no monthly/quarterly VAT return has to be submitted, but only an annual VAT return (i.e. last year's sales below 1,000 €), the ESL can also be submitted as an annual VAT return. In this case, it must be sent by January, 25 of the following year. However, this exception only applies if (in addition to the fact that no monthly/quarterly VAT return (preliminary VAT return) has to be submitted) the sum of all deliveries and other services in the previous calendar year does not exceed 200,000 € and is unlikely to exceed in the current calendar year, the sum of all intra-community deliveries or other intra-community benefits does not exceed 15,000 € each and is not expected to exceed them in the current calendar year and no new vehicles are delivered. This is a very rare case.

If no intra-community deliveries or triangular transactions are carried out but only non-taxable other services in accordance with section 18b sentence 1 no. 2 UStG (Value Added Tax Act), the ESL must be submitted on a quarterly basis (up to the 25th day after the end of the quarter). If at the same time intra-community deliveries and/or triangular transactions are carried out and due to this, a monthly submission of ESL takes place, other intra-community services can also be sent on a monthly basis. The information for other intra-community services and intra-community supplies and/or triangular transactions can therefore be included in one ESL generally.

If there are no sales for one month or quarter, no ESL is required. A so-called zero return (Nullmeldung) does not have to be submitted.

According to section 18b UStG (Value Added Tax Act), intra-community supplies (field 41), non-taxable other supplies (field 21) and intra-community triangular transactions (field 42) have to be declared in the monthly/quarterly VAT return (preliminary VAT return).

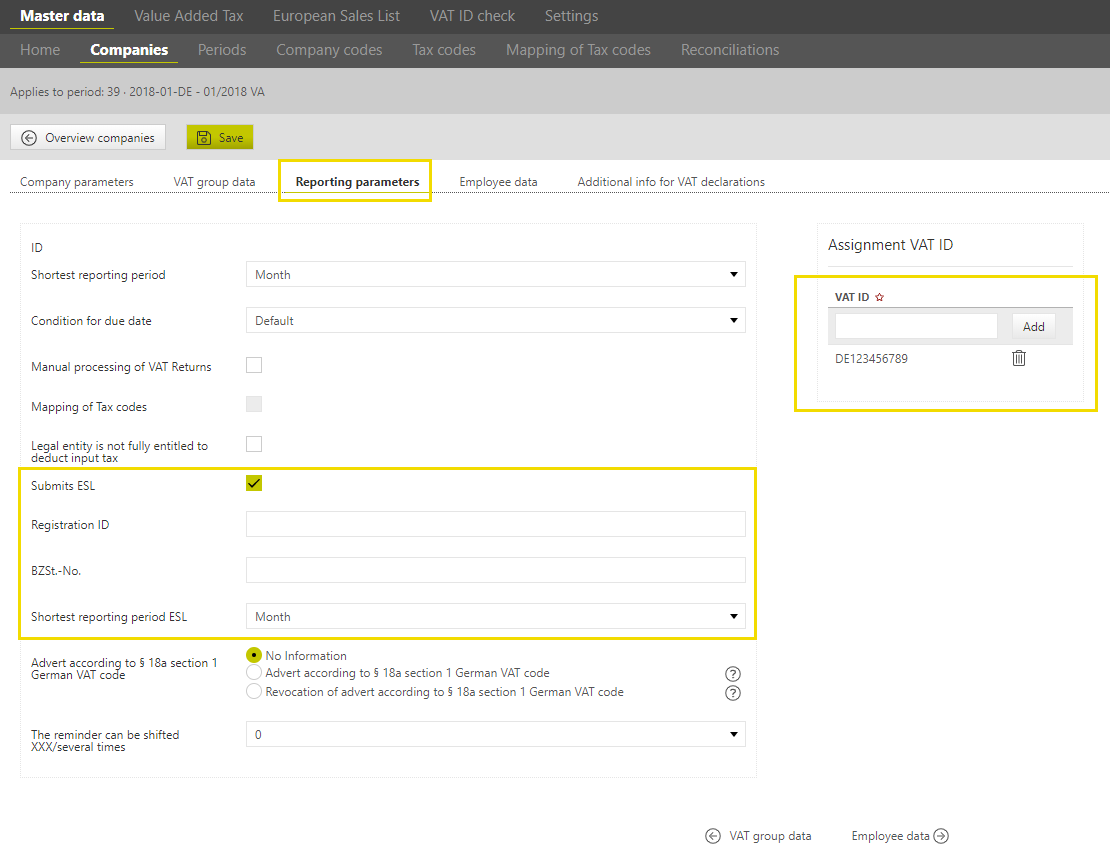

In the [Declaration] main area in the VAT@GTC the users can create and send the European Sales Listing. The tab is visible only if the checkbox [Submits ESL] is activated in the [Company] dialogue of the [Master Data] main area. In addition to that, it is necessary to select one of the monthly VAT return periods, since the ESL cannot be created for the annual VAT return and special prepayment periods.

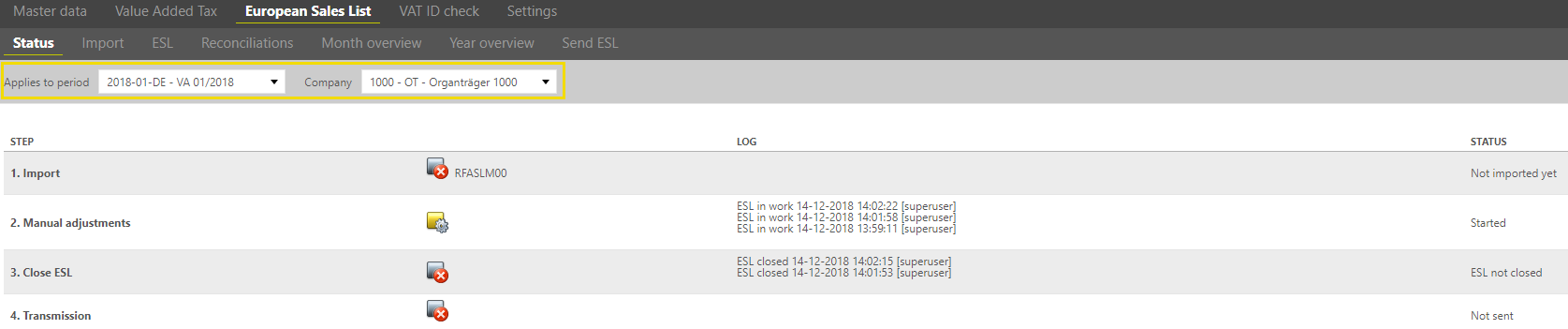

Status

The sub-dialogue [Status] works like the [Status] dialogue in the area Value Added Tax. The lower part of the dialogue window displays the individual steps of the VAT return creation process for the selected period and company. To process the ESL, first select the period and company.

After selecting the period and company, the current reporting process is displayed in an overview. The reporting status with its individual steps is based on the following scheme.

Import

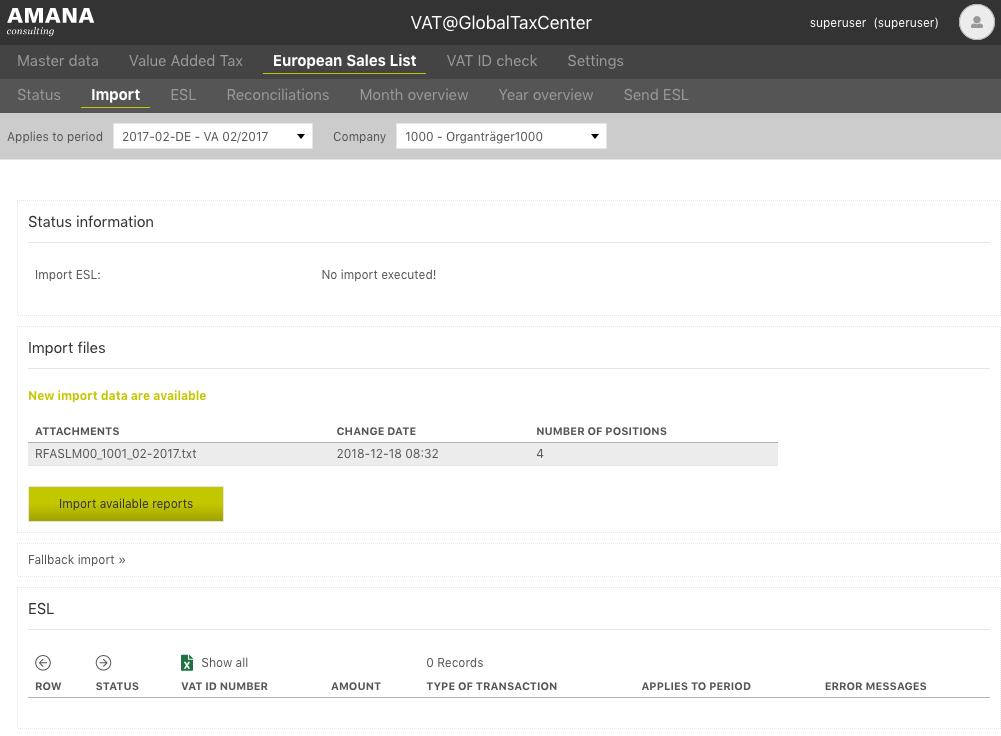

In the same way as the preliminary VAT return and the annual VAT return, the ESL can be created automatically. The values are transmitted to the ESL form from the SAP report RFASLM00 by means of Import (in the [Import] dialogue). The required report can be generated in SAP and has to be available for import under a drive path. Detailed instructions will be provided at the beginning of the project.

Good to know

When importing the ESL values, only values without decimal places can be imported, as the values in the ESL are transmitted in full euros. Normally, import files for the ESL are already generated by the source systems without decimal places.

RFASLM00 | The report contains the ESL values for the respective period. |

Import via network drive

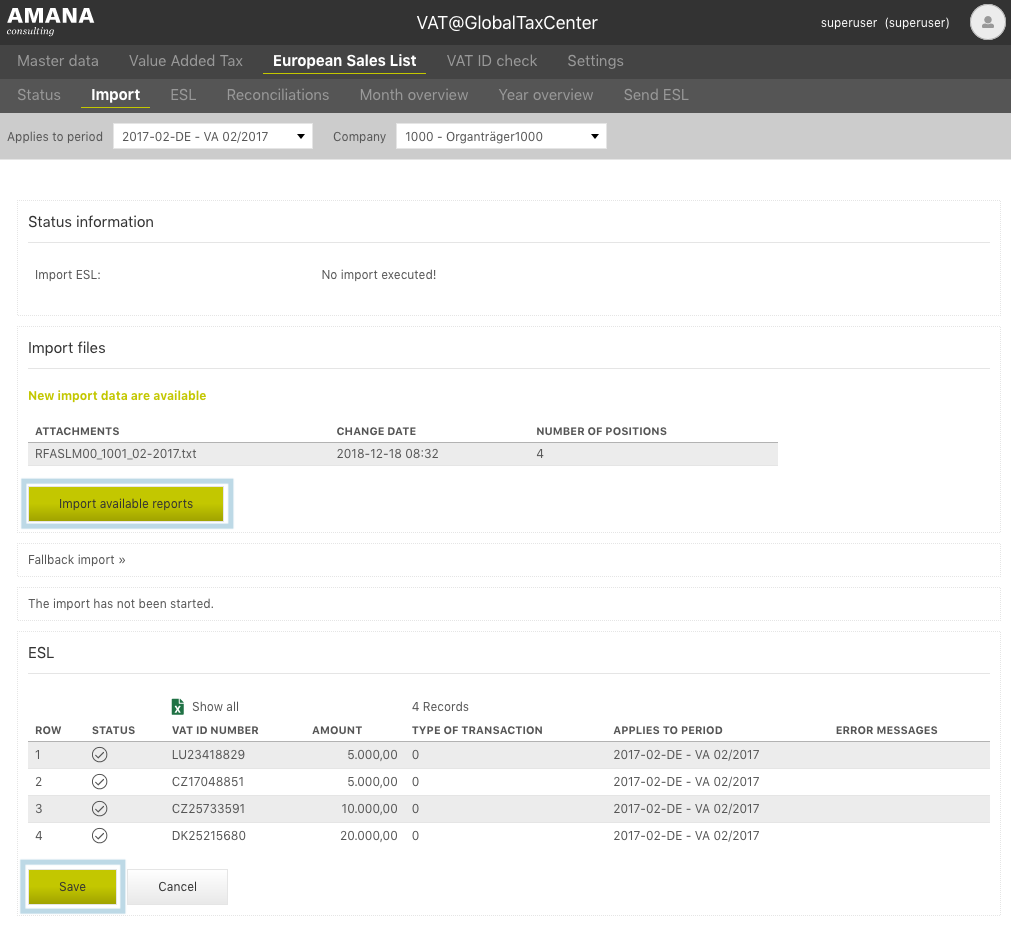

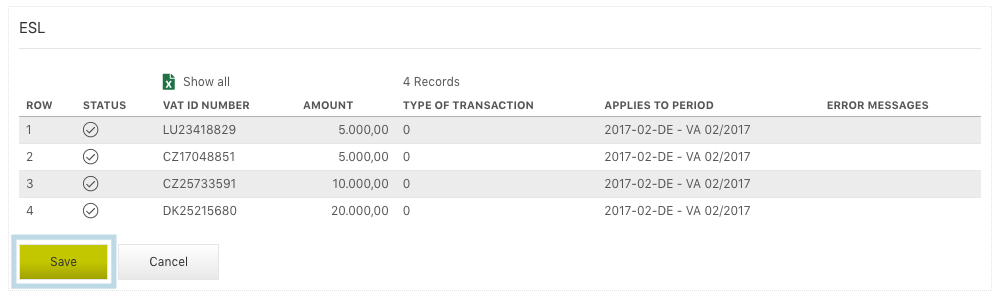

Via [Import of available reports] the reports are uploaded and can be saved. If the import has been carried out successfully, the number of data records and a section of the report appear in an overview table. If the import via network drive is not used, the [Fallback Import] option is available. First select the type of the report, find it on the local computer and import. See section [Manual Import].

The following information is displayed in the overview:

- VAT ID number: here the VAT identification number of the customer/recipient in the European Union

- Amount: net value

- Type of transaction: the VAT@GTC takes informations form Federal Central Tax Office

- [0] stands for intra-Community deliveries

- [1] stands for other services

- [2] stands for triangular transactions

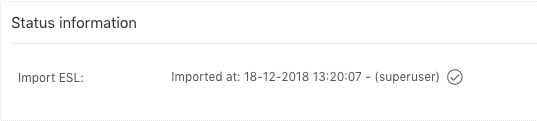

The import can be saved and the data copied to the VAT return via [Save] under the overview table. The saved report then appears in the upper half of the dialogue under [Status Information] with a [] symbol.

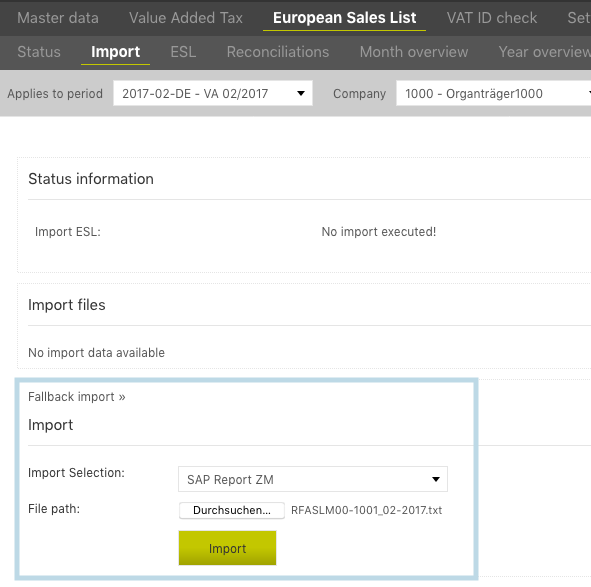

Manual Import

In addition to the import via network drive import, a manual import is also possible. First select the import type via drop-down menu and find the required file on the local computer via [Durchsuchen (browse)]. It is possible to upload two different file formats. Via [Import selection] a CSV file and a SAP report can be chosen.

If the import has been carried out successfully, the number of data records and a section of the declaration appear in an overview table. Do not forget to save the data records using the [Save] button at the end of the overview table.

ESL for company subdivisions

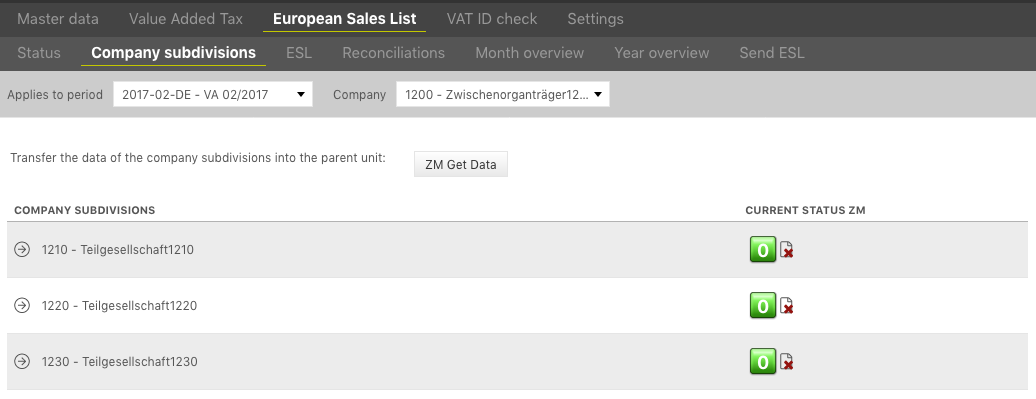

Company subdivisions are especially important for the [Declaration] in the VAT@GTC and are used to validate the numbers of several company codes, compare them to the preliminary VAT return, summarise them in an ESL and send them as a VAT return to the Tax Office.

The procedure is analogous to [preliminary VAT return: Company subdivisions]. The [Company Subdivision] dialogue is displayed instead of the [Import] dialogue. The company codes belonging to the company with their respective status are found here.

The [Arrow function] of the individual company codes opens the status area of the individual company subdivision. Only when all companies in the company subdivision dialogue have the status [Green], the user can copy the values via [Apply ESL Data].

Good to know!

Corrections should not be made in the company subdivisions. It is better to make corrections in the annual status of the group VAT return.

Declaration

The ESL is displayed in the [Declaration] subdialogue. This dialogue contains the declarations of individual companies.

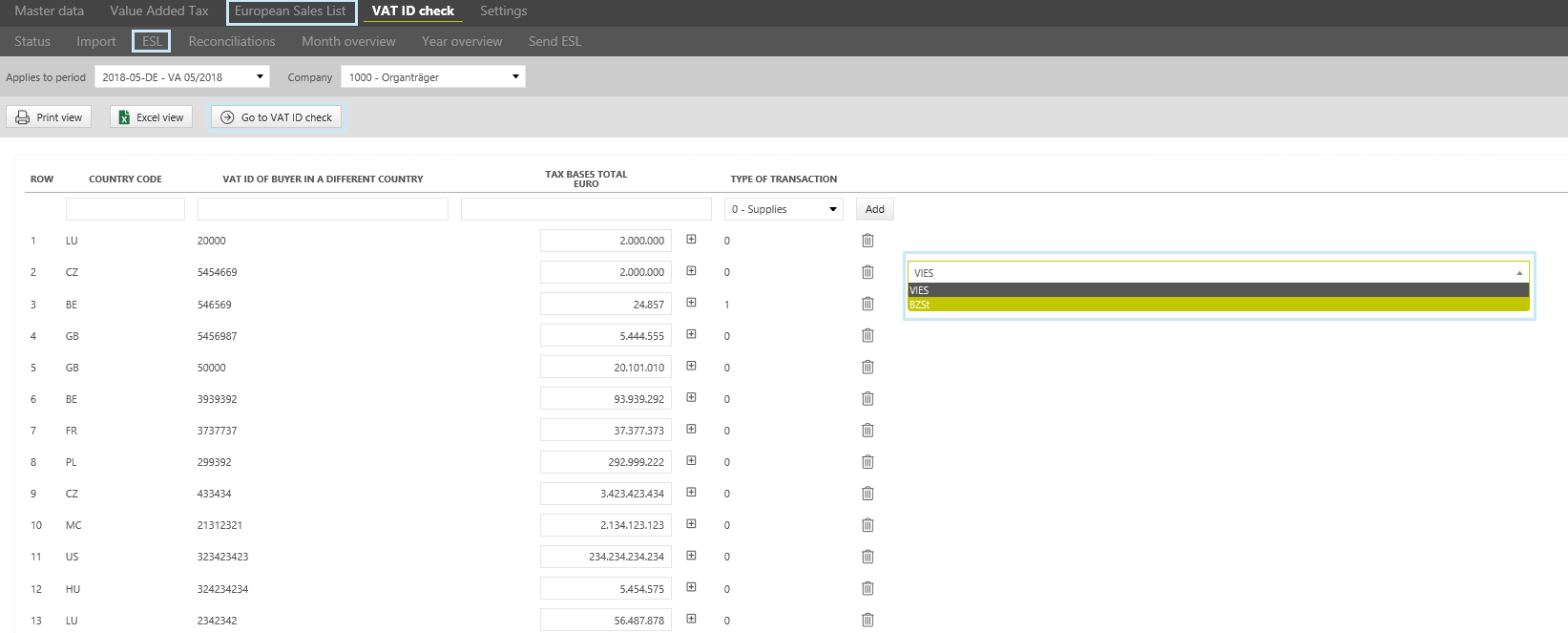

The following attributes are displayed in the [Declaration] dialogue:

Row | The consecutive number is automatically assigned by the VAT@GTC. |

Country code | The first part of the client VAT ID number. It is a two-digit code that usually corresponds to the country abbreviation form, in accordance with ISO 3166. Exception is Greece [identified not as “GR”, but as “EL”]. The country code is a required field. Its plausibility is not checked by the VAT@GTC, therefore be careful when entering the country code manually. |

VAT ID of buyer in a different country | Enter the client VAT ID number [companies in EU]. It should be noted that the length and format of the VAT ID in different countries may vary. The VAT ID is a required field. Its plausibility is not checked by the VAT@GTC, therefore be careful when entering the VAT ID manually. |

Tax bases total | Enter a consolidated tax base per activity supplied to every buyer. Three rows may be needed for one business partner, if intra-community supplies, triangular transactions and other services have been performed. Amounts in cents are ignored. |

Services | Select one of the options from this drop-down menu: intra-community supplies [other supplies “0”], other services in EU [“1”], triangular transactions [“2”]. |

Good to know!

Please make sure that the numbers are continuous. If this is not the case, the import file might contain lines that were not imported.

Create the ESL by means of "Import" function

When importing the RFASLM00 report the data are transferred to the ESL form. These fields are greyed out and cannot be changed anymore. However, some positions can be added to the ESL manually. Click on the [Create] button at the beginning of every row to save the manual changes in the ESL form. They appear in the row beneath the entry box. Several changes can be made here. If the country code and a VAT ID of an already existing position are entered, the amounts are added up. The newly created position can be viewed when clicked on [ ]. In addition, positions can be removed via [Delete]. It should be noted that the [Delete] symbol is only available for users with the corresponding permissions.

VAT@GTC offers a VAT ID check function. The [Go to VAT ID Check] button leads directly to the [VAT ID check] dialogue. For details see chapter [VAT ID Check]. Afterwards, plausibility checks can be carried out in the [Reconciliations] dialogue. The reconciliations can be carried out after import. If the reconciliations have been carried out successfully, the ESL can be closed via [Close ESL].

Manual processing of the ESL

If no RFASLM00 has been generated and imported from the SAP system, the reporting data has to be entered manually into the ESL form [].

Reconciliations

The [Reconciliations] dialogue is used to control the quality of the ESL. Currently only one reconciliation is available for the ESL [Reconciliation 9 “Reconciliation with ESL”]. It can be activated in the [Master data] main area ([Company] dialogue). The [Reconciliations] can be carried out either in the [VAT dialogue] or in the [ESL dialogue]. For more information see chapter [VAT: monthly/quarterly VAT return - preliminary VAT return: Reconciliations].

Month Overview

Since the [Month Overview] in the ESL area is similar in terms of layout and functionality to the [Month Overview] in the VAT area, more information about this dialogue can be found in the chapter [VAT - Monthly status].

Year Overview

The status of all ESLs of the calendar year (depending on the selection in the Company dialogue) can be viewed in the [Year Overview] dialogue.

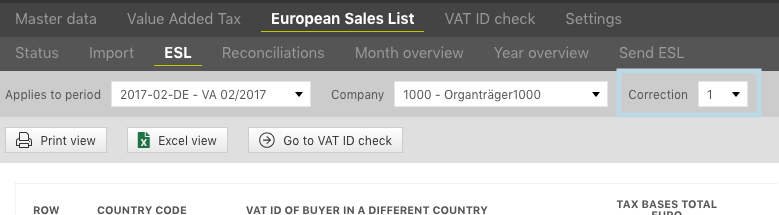

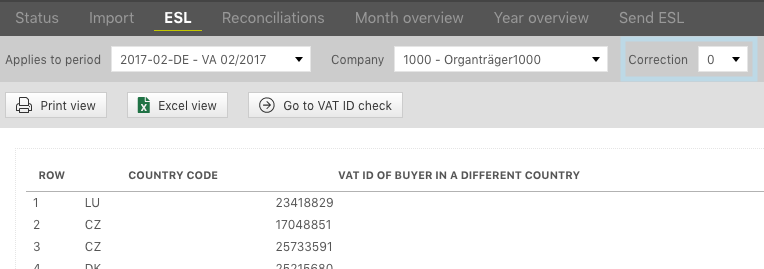

The [Arrow function] in every column is used to highlight the selected month. Use the [Arrow function] in the rows with the companies to change to the [Status] of the selected company. The meaning of the colours and the numbers is described in the chapter [VAT Monthly Status]. A correction of the ESL can be created by clicking on the [Plus sign]. The user is asked whether the correction should really be created, since once created, the correction cannot be deleted.

A correction is automatically created in the ESL area. In the ESL, the positions of the previously sent ESLs are no longer displayed. Only the correction items incl. VAT ID and country code with correction amount must be specified in the ESL. This is usually done manually.

Since only the correction items are entered and transmitted during the correction of ESL, the user has the possibility to see the previous ESLs via the [Correction] dropdown menu, when creating the correction

Send Declaration

The ESL can be sent directly to the Federal Central Tax Office using the [Send ESL] subdialogue. It is possible to check the VAT IDs via VIES or BZSt before sending the ESL (see chapter [VAT ID check]). Depending on the scope of the ESL, it is sent either via the ELMA5 procedure (mass data) or ELSTER. This is configured in the [Master data] area at the beginning of the project.

Since the [Send ESL] function in the ESL area is similar to the sending of the message in the VAT area, with regard to its layout and functionality, for more information on this dialogue see chapter [VAT: Send VAT return].