A perfect solution for the increasing requirements of the VAT compliance

ERP-independent master data Management

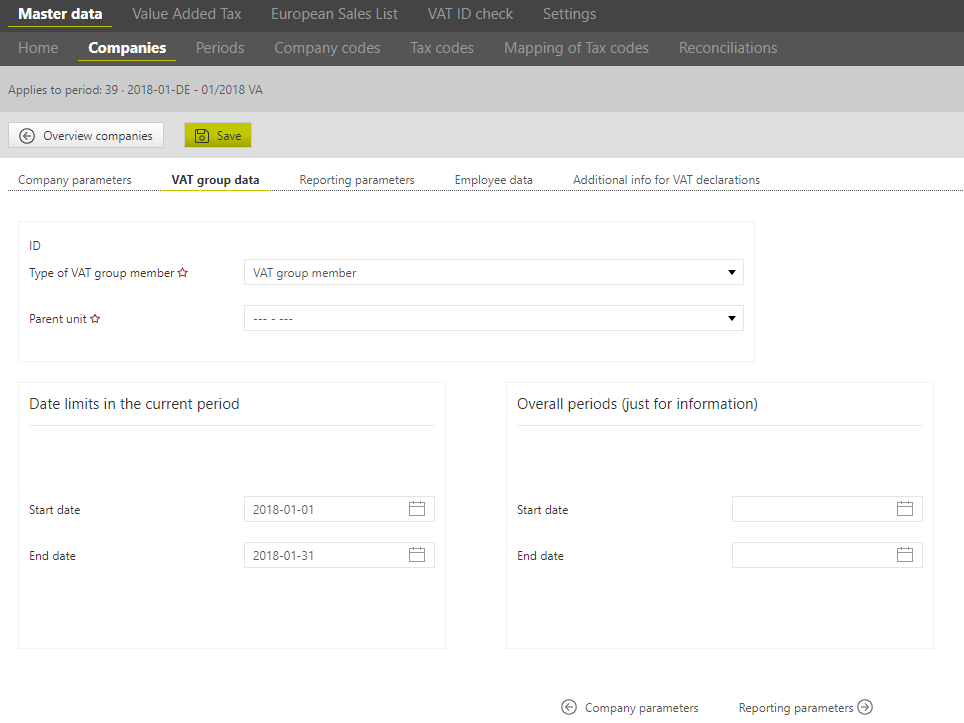

Master data is loaded to the VAT@GTC at the start of the project, including companies, tax codes and company codes. These data are always assigned to a period. Thus, the development of the VAT group can be represented on a periodic Basis.

The belonging of companies to the VAT group can be defined precisely (monthly or even daily).

Roles and user Concept

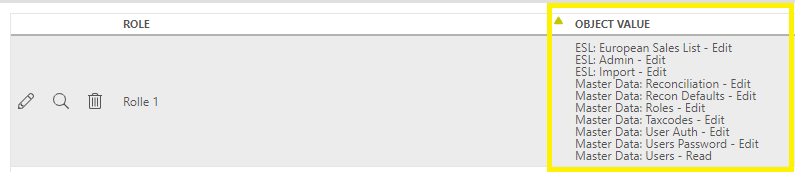

In the VAT@GTC, it is possible to define very detailed role concepts for each user. These role concepts contain authorisation object values (individual dialogues and functions are provided with such object values in the VAT@GTC).

Thus, it is possible to control what exactly the user can see and edit in each dialogue. Accordingly, the VAT@GTC makes sure that the relevant user can solely see those companies and information s/he is authorised to but no other data.

Possibility of automated import of the VAT-relevant data

It is necessary to have a SAP system, where the standard reports for preliminary VAT returns are generated. These reports are scheduled and automatically imported into the VAT@GTC via mass data import, network drive import or web Service.

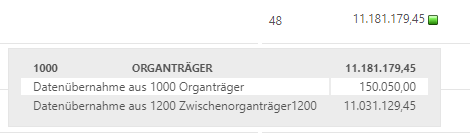

Automatic data transfer of individual preliminary VAT returns in multi-level VAT groups

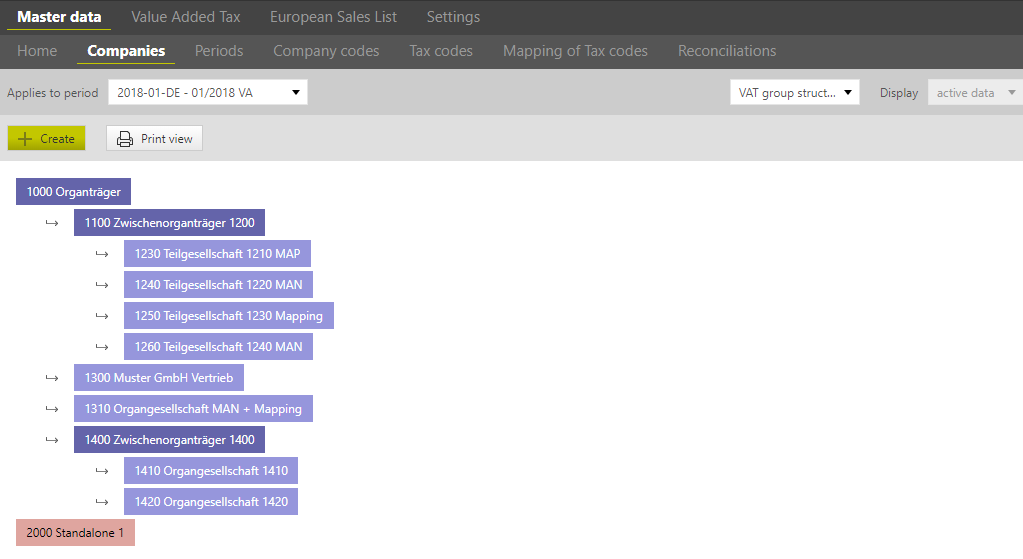

When creating the VAT group structure in the VAT@GTC, the companies are first classified and interlinked (see figure below). As a result, the values of the individual preliminary VAT returns are automatically summed, according to the created structure.

Reconciliations

The validation of the preliminary VAT return values can be usually carried out in the VAT@GTC, based on the imported SAP reports. Among other reconciliations, the tax base and the tax amount are compared based on the saved tax rate. It is also possible to check whether an incorrect type of tax code (for example, 19% VAT inland on expense account) was used for certain account groups (accounts are also imported into the VAT@GTC).

Direct submission to the tax office

incl. milestone concept for preliminary VAT return, annual VAT return, special prepayment and European Sales List

Using the AMANA Transfer Client (TC), preliminary VAT returns can be sent directly to the tax office after validation of the numbers. The generated filing protocol is saved directly to the VAT@GTC database. This is also done in connection with the milestone concept. The milestones represent certain steps in the preliminary VAT return processing. A review function is integrated.

Cross-period task management

The VAT@GTC has the so-called Resubmission function. After the SAP report import, it may still be necessary to adjust amounts in accordance with findings in the reconciliations or to make additional postings. These actions are not registered in the SAP and have to be recorded in the next period. When importing these reports in the following period, the subsequently booked amounts are automatically calculated.

Reports

The values saved in a monthly or quarterly VAT return can be grouped into reports in the VAT@GTC and represented in the Excel files for internal and external reporting purposes. An example of such report is the Excel report which shows the preliminary VAT returns of the current year including the yearly total of the selected Company.

VAT ID check and submission of the European Sales List

The VAT@GTC can be used to perform a simple or a qualified check of VAT ID numbers. A free selection of the BZST or VIES source is possible. A simple check can be combined with every ESL submission. On the other hand, a qualified check is possible with a mass data query from the underlying ERP System.

VAT compliance abroad

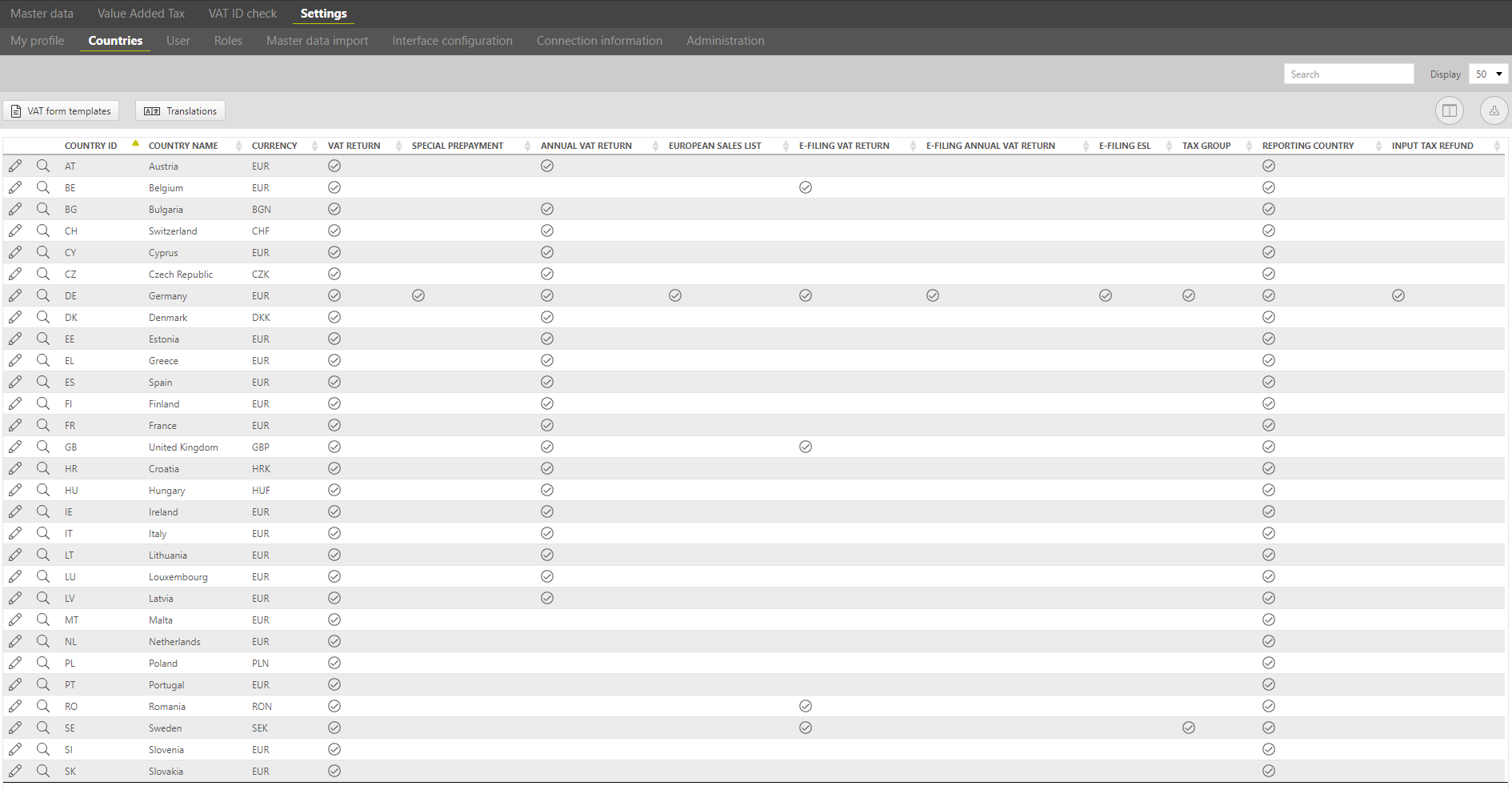

In addition to the German VAT returns, preliminary VAT returns can also be created, checked and prepared for filing in the VAT@GTC for other countries (EU + Switzerland, Liechtenstein, United Kingdom) . The VAT returns can also be sent automatically in Austria, Switzerland, Sweden, Romania, Belgium and the UK.