Tax reports

Various (predefined) reports can be opened from the Tax Reports dialogue. The selected report is opened in an Excel file and can be partially configured by the user (e.g. period to compare or FX code).

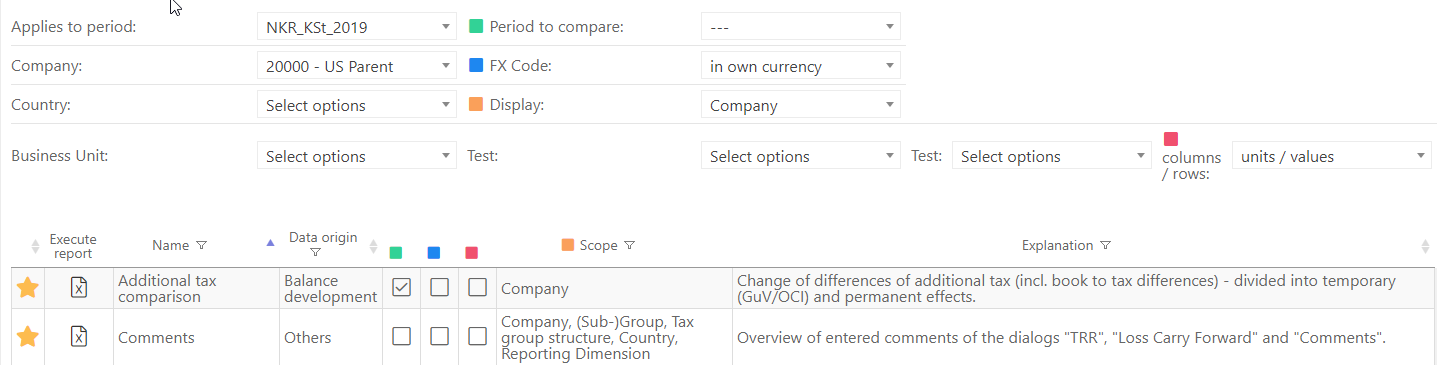

Parameters to be set

Every report is based on the selected parameters. Individual settings can be made in the dialogue header; they are described further.

Parameter | Description |

Applies to period | The period must be specified; defines the period under consideration |

Company | The company must be specified. Depending on the 'Displa<' parameter, e.g. a tax group or a subgroup is evaluated. In addition, parameter 'FX Code' is also relevant for the selected company. |

Country | One or several countries can be selected here. The dropdown list content is determined by the period selected above. |

Business Unit | One or several reporting dimensions can be selected here. The dropdown list content is determined by the period selected above or the content of the 'Reporting Dimension' dialogue. |

Period to compare | The dropdown list 'Period to compare' contains all periods created in the GTC. Prior period defined for the selected period is automatically proposed as a period to compare (so-called standard selection). However, any other period can be selected. Period to compare must be selected for reports of the balance development category. |

FX Code | In own currency Report uses the currency of the selected company. If the 'group structure' is selected in the 'Display' parameter and the company is a company from the USA (classified as a subgroup), all companies that belong to this group, e.g. also Canadian or South American have USD as their currency. In group currency Report uses the currency of the company defined as the parent company of the group (EUR) – independently of selected company. If the 'group structure' is selected in the 'Display' parameter and the company is a company from the USA (classified as a subgroup), all companies that belong to this group, e.g. also Canadian or South American have EUR as their currency. In local currency Report uses local currency defined in the 'Master Data'. Currency is not converted. If the 'group structure' is selected in the 'Display' parameter and the company is a company from the USA (classified as a subgroup), all companies that belong to this group, e.g. Canadian or South American still have their local currency. |

| Display | This parameter is relevant only for those companies for which the user is authorised. |

Columns / Row | This parameter determines the order of the generated Excel reports. Companies (values) can be displayed in columns or rows. |

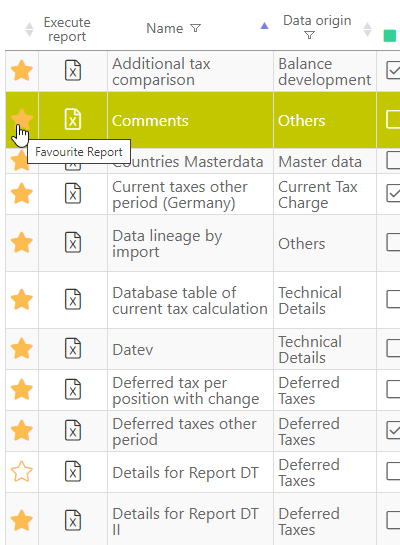

Select list Reports

Column 'Favourites'

Report list can be sorted by columns (e.g. favourites or data origin). Frequently used reports can be marked as favourites (click on a star symbol):

_Columns 'Data Origin' and parameter settings_ Report list can be divided into the following areas \('Data Origin' column\):

Balance Development (e.g. Local GAAP – Tax comparison)

ERiC Transfer (e.g. ERiC delivery status)

Deferred Taxes e.g. Rollforward deferred taxes)

Others (e.g. Comments)

Master Data (e.g. Countries master data)

Current Taxes (e.g. dialogue § 8b KStG)

Technical Details (e.g. Database table of current tax calculation)

TRR (e.g. Translation P&L results local GAAP/IFRS)

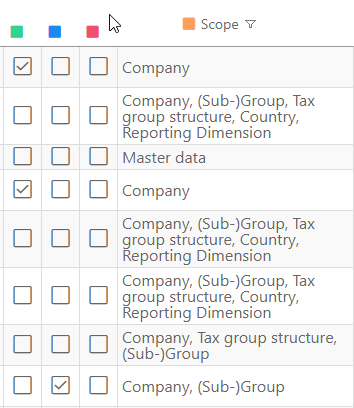

Depending on the data origin certain parameters/attributes must be specified. Settings made by the user are marked by green ticks per report. For the Translation P&L results local GAAP/IFRS report it is necessary to specify the period to compare (a green star). Other parameters are irrelevant, e.g. FX Code does not affect the report.

Column 'Scope'

Every report is based on a scope/viewpoint. The scope provides possible restrictions regarding the relevant companies:

Scope | Description |

Company | Report cannot be restricted with respect to the 'Display' parameter. Only the data for the company selected in the 'Company' dropdown menu is displayed. |

(Sub-)Group | Report can be restricted by selecting a classified as a (sub-)group company (with the corresponding 'Display' option 'Group Structure'). |

Tax Group Structure | Report can be restricted by selecting a classified as a parent company (with the corresponding 'Display' option 'Tax Group Structure'). |

Country | Report can be restricted by selecting one or several countries (with the corresponding 'Display' option 'List'). |

Reporting Dimension | Report can be restricted by selecting one or several reporting dimensions (with the corresponding 'Display' option 'List'). |

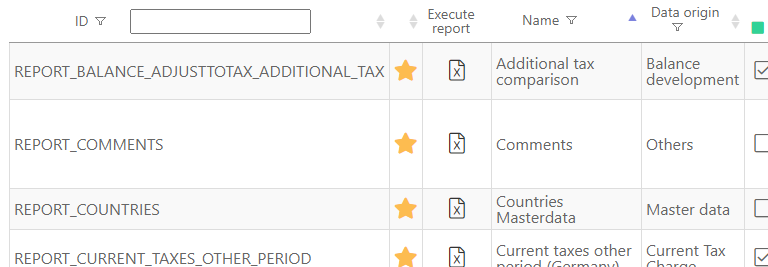

Button 'Show/hide columns'

Using the Show / hide columns-button, the technical report IDs can be displayed in a separate column.

Since report names in the GTC are revised and standardised, you can view additional column Name (alt). This column helps the user to find the report under its original name.

Generate report

Reports are generated with a click on the Excel symbol. After that the report can be saved locally or opened. The report runtime varies according to the configuration of individual parameters and depends on the hardware used by the GTC server.