The view of the [Reconciliations] dialogue is based on the settings made in the master data, only those reconciliations that were activated in the master data for the respective company are visible. Click on [Run reconciliations] to start the process, the results will be displayed in the same dialogue.

Good to know!

If the VAT return is finalised, it is not possible to run the reconciliations. The following message is displayed:

In the Reconciliation detail view individual results with different status levels can be seen.

The following overview shows different status of the individual reconciliations and the corresponding symbols.

Overview | ||

|---|---|---|

Main view in the Reconciliations dialogue – (see figure VAT: Reconciliations) | No errors / error corrected / error ignored | |

| Deviation of a reconciliation – but within the tolerance limit (in particular, for Reconciliation 9) | ||

| Reconciliation is not successful | ||

| For more information go to [Good to know!] under the table | ||

| In individual reconciliations | Reconciliation contains no errors Special feature reconciliation 1: Reconciliation contains errors – within autolimit | |

| Reconciliation is open (edit field is below the reconciliation details) | ||

| Reconciliation successful after manual adjustment | ||

| Corrected error message | ||

Reconciliation contains errors |

Good to know!

Compulsory reconciliations or shifting of open reconciliations are connected to the resubmissions.

Reconciliations can be marked as mandatory in the master data in the [Reconciliations] dialogue. If this is the case, findings cannot be moved to the subsequent period. If the reconciliation contains errors, the message [Completion cannot be shifted again] appears. As a result, the VAT return cannot be finalised and cannot be sent.

If the reconciliations are marked as [not mandatory], the number of times these errors can be shifted can be defined in the respective company dialogue under the [Reporting parameters]. If the [The reminder can be shifted XXX / several times] setting is bigger than 0, the [Completion can be shifted into next period] option is displayed in the dialogue. It has to be activated using the available checkbox. Thus, the open reconciliation for this period is also done in the current resubmission.

Good to know!

Reconciliation 1: Plausibility of VAT amounts in the VAT report

Reconciliation 1 checks whether the VAT in the tax report [RFUMSV00] matches the amount resulting from the multiplication of the stated tax base with the VAT rate of the tax code (saved in the Master Data). Possible inconsistencies are usually rounding differences.

The values from the [RFUMSV00] are displayed in the reconciliation table in the columns [Assessment base from VAT return] and [VAT form VAT return]. The VAT@GTC calculates the respective tax or tax base for these values and compares them with each other.

Example 1

19% | Audit | Values from RFUMSV00 | Calculation VAT@GTC: | Reconciliation |

|---|---|---|---|---|

Tax value | 190 € | 1.000 € x 19 % = 190 € | ||

| Tax base | 1.000 € | 190 € / 0,19 = 1000 € |

If the posted values from the report do not match the calculated values, the reconciliation fails.

Example 2

19% | Audit | Values from RFUMSV00 | Calculation VAT@GTC: | Reconciliation |

|---|---|---|---|---|

Tax value | 50 € | 1.000 € x 19 % = | ||

| Tax base | 1.000 € | 50 € / 0,19 = 263 € |

If e.g. in RFUMSV00 tax base is EUR 1,000 and as the VAT tax amount is EUR 50, the VAT@GTC calculates the tax on the basis of the tax base [EUR 1,000 EUR x 19% = EUR 190] and then the tax base on the VAT amount in RFUMSV00 [EUR 50 ÷ 0.19 = EUR 263]. This reconciliation results in obvious differences (this will be shown in the status).

The calculated values are inserted into the columns [Calculated tax base] and [Calculated tax].

Different adjustment options

Automatic correction

As described in the [Countries – General Information] section, an auto limit can be set for the reconciliation. Amounts within this limit are automatically adjusted during the RFUMSV00 import and their status is set to done with the processing status green. These adjustments are only visible to the user in the change log.

Automatic corrections therefore no longer have to be made by the user in reconciliations. However, they appear as open tasks in the resubmission, when the flag VAT_RECON1_RESUB_LIMIT is deactivated.

Manual adjustment

If there are deviations between [Assessment base from VAT return] and [Calculated tax base] or [VAT from VAT return] and [Calculated tax] and if these are above the set auto limit, manual changes can be made in the [Edit] column.

After selection of the corresponding row, a processing field under the reconciliation table is opened, tax base or tax can be adjusted here. In this case, the user has to decide whether the tax base or the tax is decisive for the VAT return.

Good to know!

If the manual changes have been made and saved via [Save ], the adjusted

reconciliation is displayed as completed in the processing status. The [Rec. result] column indicates adjusted reconciliations with a [] and error-free reconciliations from the start by a green checkmark []. All changes can be viewed in the change log. The changes can also be seen in the VAT return form.

Reconciliation 2: Comparison of G/L account with VAT return

This reconciliation requires a separate G/L account VAT to pay or recover. A G/L account VAT to pay or recover calculated in the VAT return is compared to the balance of the relevant payload account (RFBILA), which has been imported for the current month.

If no payment account is stored, this message appears:The account from the (RFBILA) can be changed by the user in the master data [Reconciliations: Manage reconciliation accounts] area. In addition to the main import of all balance sheet accounts (usually without IFRS accounts), a separate G/L account VAT to pay or recover can be entered. Make sure that the number and name are the same as the imported account.

Good to know!

To ensure the proper processing of the G/L account VAT to pay or recover, filter the account from the list of all imported accounts using the “search function”, copy the number and description into the field.

The amounts in this reconciliation do not match. Possible reasons:

- Account clearing of the G/L account VAT to pay or recover is not monthly

- Remaining residual amounts on the account

- Shift of account clearings by means of the permanent extension of the filing deadline

The aim of this reconciliation is primarily the process-related derivation of the difference. After the successful reconciliation, it is necessary to adjust the VAT return or the account balance.

Different adjustment option

Adjustment of the Declaration

Amendments of the declaration is an exception (Reason: changes to tax codes or additional entries are made in reconciliation 1 and directly in the VAT return form).

The selection of the tax code in conjunction with the tax code type is very important for the adjustment, as well as the accurate input of the correction value (please use the exact amount including the sign as specified by the system for every tax code type).

However, it is recommended not to make the adjustment in this reconciliation. Alternatively, do the folowing:

- Apply changes directly in the VAT return form by adjusting the respective tax code in the corresponding box.

- Run reconciliation again - after this, the status should change to [Successful].

Good to know!

Only tax codes that have been mapped to a tax field can be adjusted.

Adjustment RFBILA

The adjustment of the relevant the G/L account VAT to pay or recover from the balance sheet is the standard procedure in the case of a reconciliation difference. The respective account is specified by the VAT@GTC. However, another account can also be selected. The use of the right sign is important for the adjustment. The sign is also specified by the VAT@GTC. As described in the section [Reconciliation 1: Plausibility of VAT amounts in VAT report V00], it is important to be able to derive the process-related difference in process. If this is not the case, the reconciliation should be deactivated for the company.

It is recommended to enter a meaningful comment in the comment box. In addition, attachments can be uploaded in the change log of the reconciliation.

If the reconciliation is set to status [green], there are no notes in the resubmission of the current period (assuming there are no open tasks from the previous months).

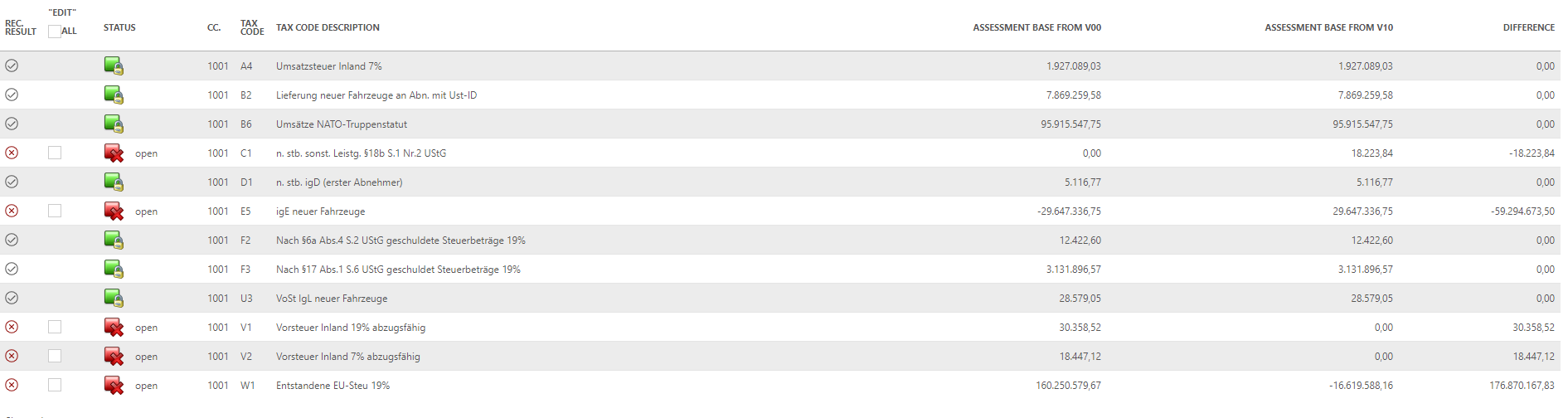

Reconciliation 3: Differences between VAT reports V00 and V10

Reconciliation 3 compares the amounts of the tax base from the reports RFUMSV00 and RFUMSV10 (monthly/quarterly VAT return (preliminary VAT return) and additional list) per tax code. Differences are displayed in an overview table.

Possible reasons for differences are deliberate or incorrect settings in the SAP system or a modification of the standard report. Based on the cause of the differences, it must be decided to what extent the monthly/quarterly VAT return (preliminary VAT return) values have to be adjusted. In addition, it must be selected whether the tax base of the RFUMSV00 or the RFUMSV10 should be decisive for further reconciliations. Since matching the tax bases of both reports is important for the completeness and accuracy of the monthly/quarterly VAT return (preliminary VAT return), this reconciliation is also the basis for the reconciliations 4 to 8, where both reports are used. If the reconciliation 3 contains errors, the system will inform the user in the subsequent reconciliations.

Good to know!

It is recommended to collect the differences for the companies over the first few months, send the incorrect tax codes to the SAP department using the [Excel view] and search together for possible reasons.

Different adjustment options

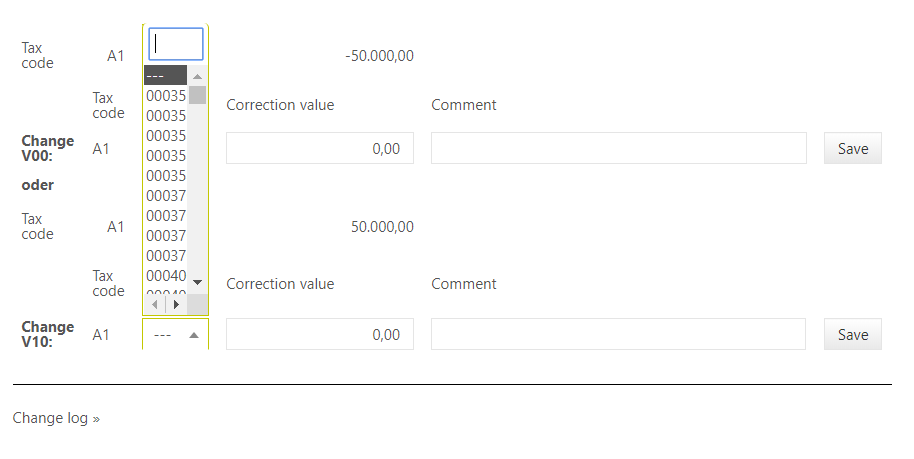

Adjustment of V10

The RFUMSV10 must be adjusted to the RFUMSV00. This adjustment does not result in a change to the reporting form, since the RFUMSV10 is not used to create the monthly/quarterly VAT return (preliminary VAT return) in the VAT@GTC.

When adjusting the RFUMSV10, an account must be selected in the detail view next to the specified tax code. All accounts available in RFUMSV10 and posted in the balance sheet for tax purposes are available for selection. If the required account does not appear in the list or if no special account is to be created, select the default account [---].

Adjustment V00

The RFUMSV00 is not adjusted to the RFUMSV10, since the RFUMSV00 is the standard SAP report for the monthly/quarterly VAT return (preliminary VAT return) and consequently the RFUMSV10 must be adjusted.

- Select the row.

- Upon selection, the detail view opens in which the RFUMSV00 can be adjusted.

- After saving, there will be no difference in the tax code.

- The amount is automatically copied to the VAT return.

Please make sure that no posting-relevant change arises from this item in the resubmission.

Reconciliations 4-6: Completeness check of revenue, expense and balance sheet accounts

The VAT@GTC follows certain rules regarding the signs during the standard report import. In the reconciliations 4, 5 and 6, the values from the RFUMSV10 are compared with those from the RFBILA. This results in the following challenge:

- When importing the RFUMSV10, the existing amounts per account are adjusted based on the tax code (VAT = reversal of the sign/input tax = the sign is left as it is).

- When importing the RFBILA, however, the amounts are adjusted based on the accounts (asset/expense account = the sign is left as it is, passive/income accounts = reversal of the sign).

Thus, the findings contain no errors. Here is an example to make it clear: Standard booking from accounting: Expense on liability

- As a rule, an input VAT tax code is expected here because it is a company’s purchase.

- Regarding the expense account, the logic is: The sign for expense accounts is not reversed (RFBILA) as well as the sign in the input tax (RFUMSV10).

- For the passive account, on the other hand, the sign is reversed (RFBILA) and the input tax is left as it is (RFUMSV10).

Content of the reconciliations

The reconciliations compare the values of the account balance from the RFBILA of the respective account type with the corresponding totals from the RFUMSV10.

The reconciliations can result in the following deviations:

- Value RFBILA is bigger than value RFUMSV10 This is an indication of existing bookings without tax code. If the value from RFUMSV10 is 0, this may be related to a non-tax-relevant account (especially in the reconciliation 6).

- Value RFUMSV10 is bigger than value RFBILA This is an indication of a faulty correction booking.

When processing the reconciliations, it can be decided whether this is a VAT report relevant or not relevant deviation. If the deviation is not relevant, the finding is set to the status [green].

Good to know!

However, if the deviation is relevant, the value from the RFUMSV10 or the RFBILA must be adjusted. This does not have any direct impact on the VAT return. These adjustments must therefore be made directly in the VAT return.

Good to know!

If any findings appear during the first months of the project, these can be set to [not VAT report relevant] in the VAT@GTC. Generate an Excel document with the findings (can be done directly in the Reconciliation dialogue) and discuss it with the accounting department. In addition, it can be decided at a later point whether the not VAT-relevant accounts can be deleted from the master data area of the VAT@GTC. Thus, these are no longer taken into account in the reconciliations.

Good to know!

If no tax codes of tax code form ESE or VST have been created, reconciliation 5 cannot be processed.

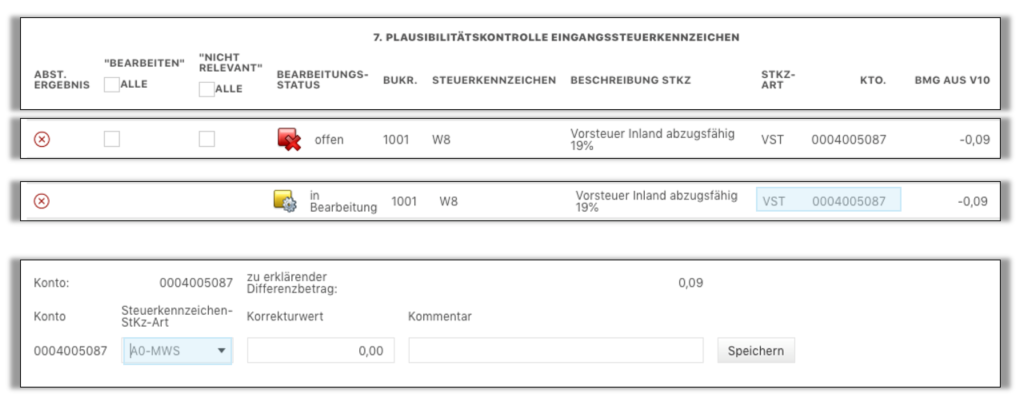

Reconciliation 7-8: Plausibility check input and output tax code

Bookings with certain tax codes and thus types of tax code (VAT and input tax) are usually posted to the same account groups.

Accounts of the profit and loss account are important here, they are checked by reconciliations 7 and 8. The RFUMSV10 serves as the source.

In reconciliation 7 all accounts booked in RFUMSV10 with input tax or ESE are checked with regard to incorrectly booked liability or revenue accounts.

In reconciliation 8 all accounts booked in RFUMSV10 with output tax or ESA are checked with regard to incorrectly booked activity or expense accounts.

Possible reasons for reconciliation failure:

- Account has been classified incorrectly in the master data area (delete and create new account)

- The finding is not an error (for example, a negative income was booked on the expense account and is therefore not relevant)

- The finding is an error and has to be edited

If the finding is an error, proceed as follows:

The amount must be recorded with the tax code. The editor must perform the following 3 steps:

- If this affects the VAT return, the editor must make an adjustment in the VAT return form

- The booking to the account in SAP must be cancelled

- The amount with the correct tax code has to be entered again (please note that this is usually a booking in the subsequent period - this must be taken into account in the VAT return)

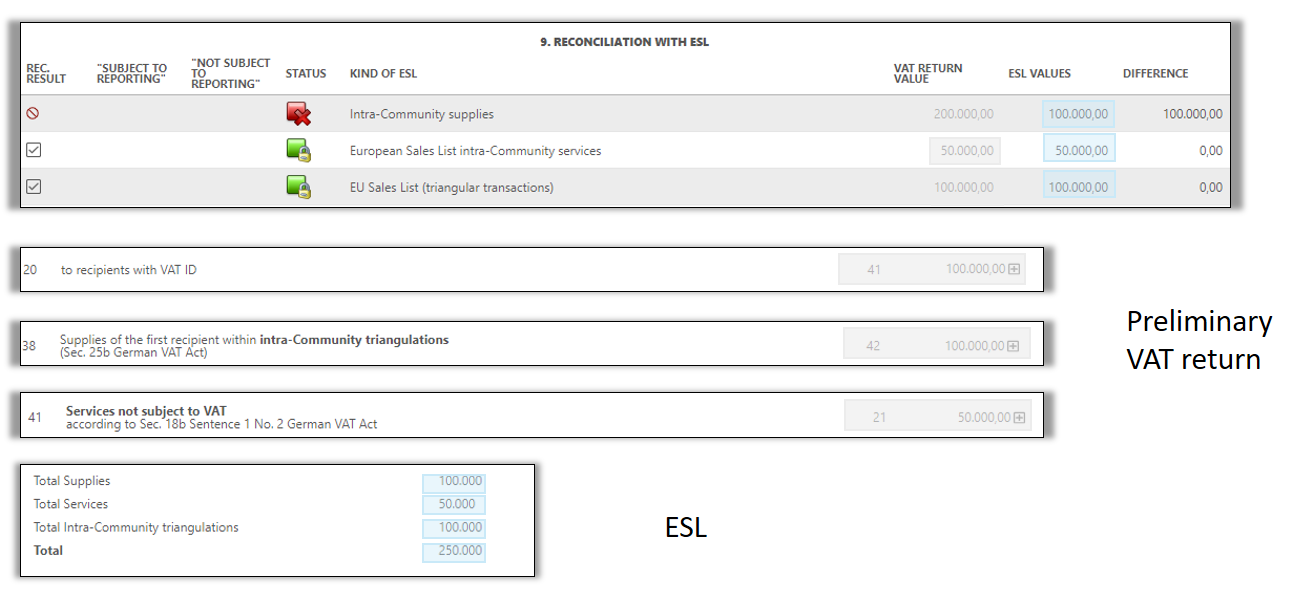

Reconciliation 9: Reconciliation with ESL

The aim of the reconciliation 9 is to identify whether the reported values in the ESL match to the values in the monthly VAT return. In order to perform this reconciliation in the VAT@GTC the amounts reported in the ESL are needed.

The tax code defines what relevant values from the VAT return are used for the reconciliation. That is why it is necessary to identify in the [Tax Code] dialogue in the [Master data] main area whether they are relevant for the ESL. Using the form field assignment in the [Mapping of tax codes] dialogue the VAT@GTC differentiates between the intra-community supply (field 41), reverse charge supply (field 21) and intra-community triangular transactions (field 42). In the reconciliation the tax bases of the tax codes mapped to these fields are added and compared with the entries in the import dialogue or added up import data.

Run reconciliation

The master data can be used to specify whether the reconciliation is to be carried out during the monthly VAT return or ESL. The deadline for VAT return submission is the basis for decision-making. In the case of a permanent extension of the filing deadline, the ESL (25th of the following month) shall be submitted before the monthly VAT return (10th of the next but one month). The reconciliation therefore makes sense during the submission of the monthly VAT return. If necessary, a corrected VAT return must be prepared.

If the monthly VAT return is submitted before the ESL, the reconciliation must be carried out with the ESL, since both data sets are available then.

Reconciliation difference

This reconciliation always results in differences, since, in contrast to the monthly VAT return, the amounts in the ESL do not contain cents (the amounts are displayed in euros when importing the RFASLM). Thus, in large ESLs the differences cam amount to more than € 100. The user can set a tolerance limit in the master data (optionally with absolute amount or percentage). If the deviation is within this tolerance limit, the reconciliation is no longer faulty, but is displayed with a yellow exclamation mark.

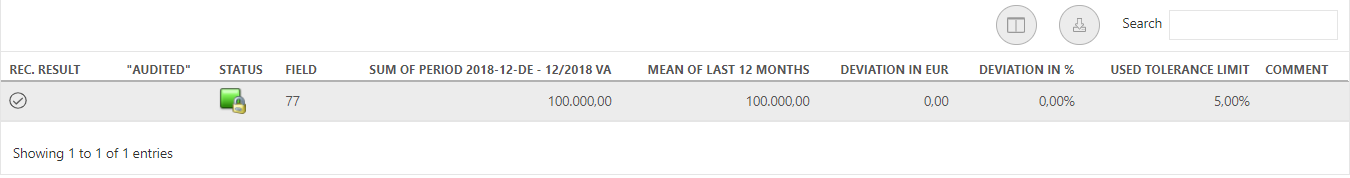

Reconciliation 10: Deviation from the mean of the last 12 months

Good to know!

The reconciliation 10 only makes sense for a company with the constant fiscal year.

Reconciliation 10 calculates the variance between the specified field value of the current month and the average mean value of this field over the last 12 months.

The configuration is possible in the [Master data] area under [Reconciliations]. To check the requested field, a tolerance limit hast to be specified.

For a more detailed analysis, the 12-month comparison with mean deviation report should be used.

Reconciliation 12-13: Plausibility check

Good to know!

These reconciliations make sense only if the company has a right to full VAT deduction.

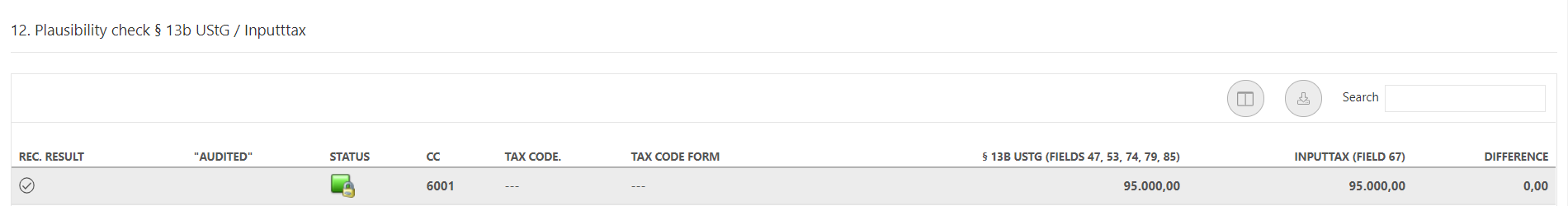

Plausibility check § 13b UStG / Inputtax

This reconciliation controls whether the tax value that applies to the reverse charge turnover matches the value in the input tax field that is applicable to the reverse charge turnover.

The VAT@GTC controls whether the taxes from the RFUMSV00 under the § 13b-UStG [Inputtax] (identification by means of tax code mapping to monthly return fields 47, 53, 74, 79, 85) match the input tax, identified in the monthly return field 67. Deviations can result from rounding differences (e.g. if the tax base is considered as correct).

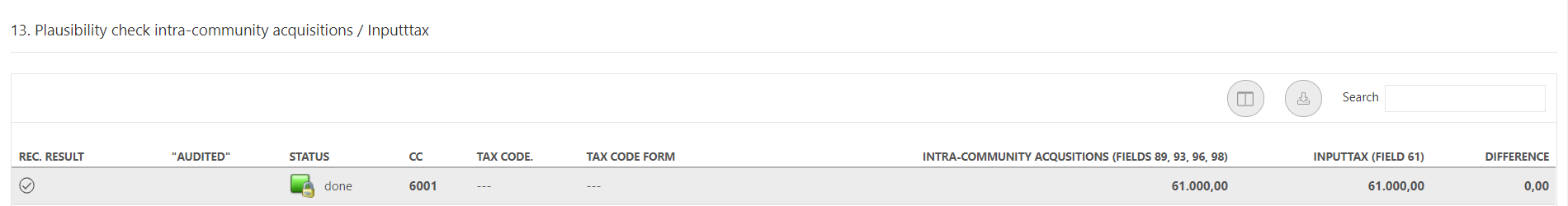

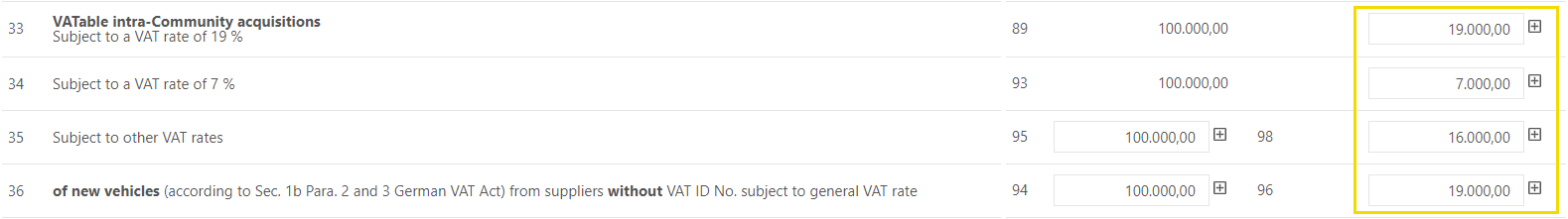

Plausibility check intra-community acquisitions / Input tax

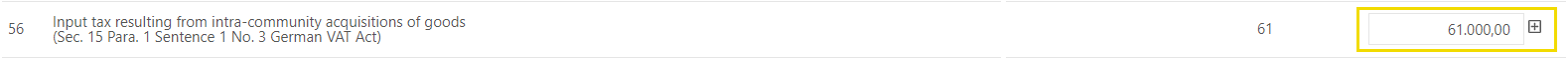

This reconciliation controls whether the tax value that is applied to the intra-community acquisitions matches the value of the input tax that is applicable to the intra-community acquisitions. The VAT@GTC controls whether the taxes from the RFUMSV00 under the intra-community acquisitions (identification by means of tax code mapping to monthly return fields 89a, 93a, 98 and 96) match the input tax value, identified in the monthly return field 61. Deviations can result from rounding differences (e.g. if the tax base is considered as correct).

If certain tolerance limits are not exceeded in these two reconciliations, the user has the choice to ignore the difference or take this resubmission into the next period, where it can be checked again.