...

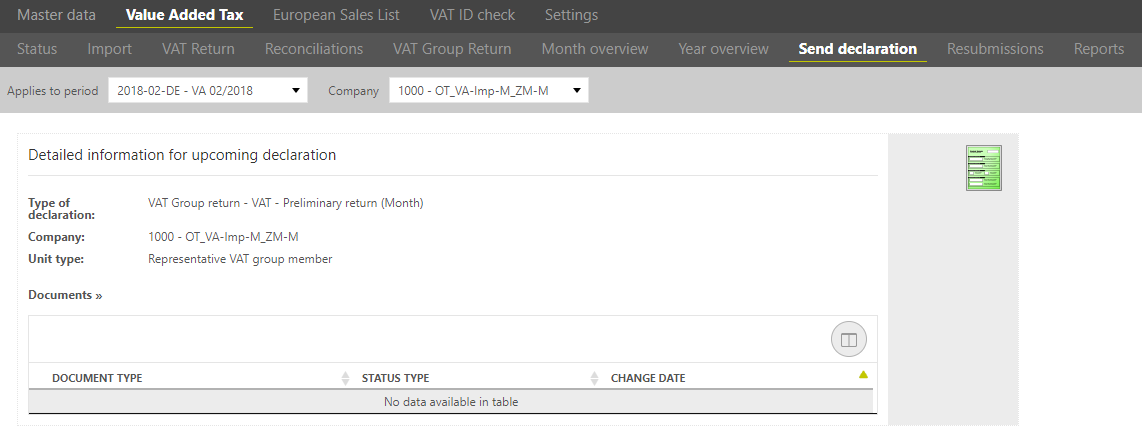

After the VAT return is created and all reconciliations are processed successfully, the VAT return can be send to the tax office using the [Send VAT return] dialogue. This dialogue is available only for the standalone companies and representative VAT group members.

The VAT@GTC has an ELSTER interface function to the so-called Transfer-Client (TC). The authenticity of the sender can be ensured by signing the VAT return with the corresponding user or company certificate (saved in the [Master data] main area).

Depending on the country and the activation of modules, there are three different levels of automation for sending the declaration:

- Sending the declaration directly from the application offers the greatest degree of automation. This is currently available in Germany, Austria and Great Britain.

- An intermediate level is formed by the interfaces with file download and subsequent upload in a portal of the tax office. This function is available for Belgium, Sweden, Romania and Switzerland.

- In all other countries there is no interface to the tax office. Here, a PDF export of the declaration can be made in the dialogue Send declaration, which can be used to transmit the declaration.

...

| Tip | ||

|---|---|---|

| ||

| It is obligatory to enter the Depending on the reporting country, not only data from the declaration is transferred, but also some master data. In Germany, for example, it is mandatory that the company's tax number, localtax office number, theaddress and the responsible person for the VAT return (incl. tel. number and email address) in the [Master data] main area. The electronic sending of the VAT return is not possible without these data. |

The sending of the VAT return can be carried out automatically via the web service or manually via the TC. The type of sending was determined during the implementation project, its description can be found in the following sections.

Automatic filing via Webservice

The following functions are only visible when the VAT return is finalised.

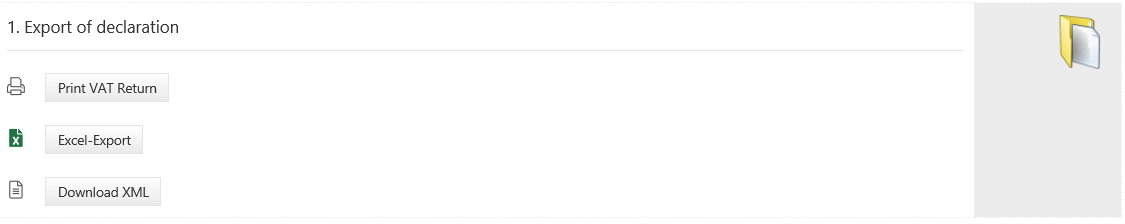

1. Export der declaration:

With help of this function the report can be printed or exported to Excel. Moreover, it is possible to download the file as XML file. If the transfer of data is not possible, the XML file can be used for failure analysis. Manual transmission is also possible, when webservice should not be used and TC is locally installed.

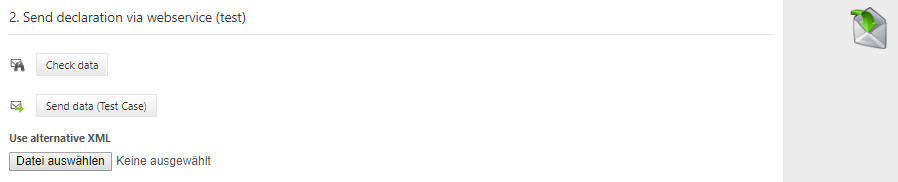

2. Send declaration via webservice(test):

Via [Check data] the credibility of the data as well as the transfer to the tax authorities is checked presupposed that the connection is valid. The VAT@GTC in association with the TC sets up a XML file based on the VAT return values, which audits completeness and technical credibility with the help of ERiC. Recorded failures in the log file have to be analysed. One reason for that could be missing Master data maintenance. As a consequence, missing information with ragrd to the company’s Master data have to be completetd in order to be able to send the declaration to the tax office.

Before data is actually sent productive to the tax office, it is recommended to send it via test case in advance. Additionally to the validation via [Check data] the submittion of test case causes that the above mentioned XML file is actually sent to the tax authorities, but with the notation that it is solely a test case.

- When data is successfully sent to the tax office, a log file is sent back and the test case data is discarded.

- Not getting a log file back indicates connections issues. The problem could be a wrong configuration on the connection server or a failing connection to the server of the tax office. We recommend to try it again at a later time. If this problem occurs again, the IT service should be contacted.

- If the log file contains error maessages, the failures are to be fixed.

agent (including telephone number and e-mail address) are stored in the master data. Without this information, no electronic transmission can take place. Affected master data in other countries can be found in the section Besonderheiten Ausland#60895824 (Specialties of foreign countries, available in english). |

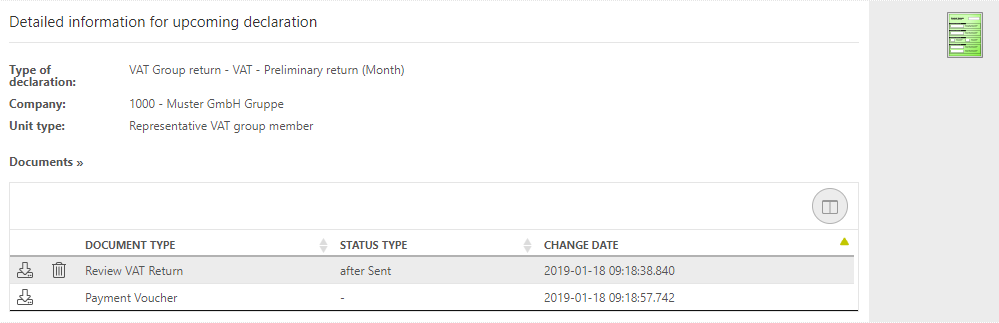

In the upper part of the dialogue, there is first detailed information on the pending declaration, as well as a document repository, which is filled in the process of creating the declaration. Then, depending on the automation and country, there are different steps that are carried out in the [Send declaration] dialogue.

Automatic filing

Export of declaration:

This step is available at any time, regardless of the status of the declaration.

The declaration can be exported as a PDF file. For the German declaration, it is also possible to export the declaration as an Excel file. In Germany and Austria, the XML file can also be downloaded, which is also used when sending the declaration to the tax office. This serves to support an error analysis in the event that a dispatch should not be feasible.

Send declaration via webservice(test):

This function is only available if the respective tax office provides an interface for a test transmission. This is the case for Germany and Austria. This step is only enabled when the declaration is closed. Depending on the country, there are up to 3 functions here:

- [Check data]: This function is only available in Germany.This function checks the plausibility of the file. In doing so, the VAT@GTC creates an XML file from the reporting data in connection with the TC, which is checked for completeness and technical plausibility. If the log file shows errors, the error indications listed must be followed up. The reason for this could possibly be insufficient master data maintenance. Consequently, the missing information must be entered in the company master data in order to ensure that the tax case can be sent.

- [Send data (Test Case)]: Before actually sending the data, you should always test the transmission beforehand. In addition to the check via [Check data], sending the test case causes the generated XML file to actually be sent to the tax administration, but with the note that it is a test transmission. If the test transmission is successful, a log file of the tax administration is sent back and then the file sent for test purposes is discarded. The test log can be accessed under Documents. If the test transmission is faulty, this can have 2 types of causes:

- On the one hand, this may be due to connection problems, such as incorrect configuration on your own connection server, or due to the fact that there is no connection to the tax administration's server. It is recommended that the transmission be carried out again at a later point in time. If this does not lead to the desired result, technical support should be obtained.

- On the other hand, it is also possible that the generated file of the declaration is still incomplete or not plausible. In this case, the error message must be edited technically.

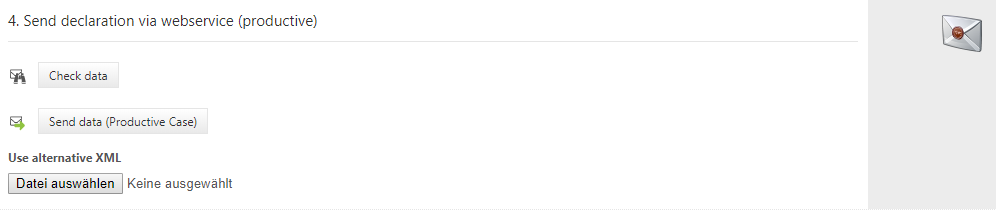

- [Use alternative XML]: This function should only be used in consultation with AMANA in case of problems with the transmission. Therefore, only the superuser is authorised to use this function. Here, an XML file is uploaded from the local computer and sent to the tax office. However, this file does not have to correspond to the declaration stored in the VAT@GTC.

Send declaration via webservice (Productive):

The options offered under production transmission are the same as for test transmission, but only for the production case.

As in the test case transmission, the same function [Check data] is also possible offered here for Germany.

In When sending in the productive live case, the XML data file is sent by authentication through the ELSTER certificatewith the authentication stored in the VAT@GTC. This differs depending on the country. The log files transported from transmitted by the tax office are submitted from the TC administration are transferred to the VAT@GTC and saved stored in the database. By conducting the productive caseThe log can then be downloaded from the document repository. When the real case is executed, the milestone of for this period is set to sent for the company is converted. After that the declaration cannot be opened again so that corrections are only possible in a corrected VAT return.

The filing protocol which is generated after every dispatch under [Documents], is only a copy for the company's own documentation. Also is the authentication advice visible on the first side of the report.

, so that it is no longer possible to open the declaration. Changes to the notification data can only be made via corrections.

Download XML-file

Export of declaration

As in countries with direct interface, there is also this step for all countries with XML download function. The XML file can be downloaded here for audit.

Export of declaration for sending

This step also offers the download of the XML. However, only the download in this step changes the status of the declaration. The milestone is set to "sending" (green-blue milestone). At the time of the download of the XML file, the milestone is not set to sent, because it cannot be assumed that this file has been received by the tax office.

Mark declaration as sent

Since there is no information on whether the file has been received by the tax office when the XML file is downloaded, this step can be maintained manually. With this function, the status of the declaration is set to sent (blue milestone). Only when a declaration is considered to have been sent can a correction be created. This is therefore a necessary step.

No interface to tax office available

If neither the function for direct transmission nor the XML download function is available or activated for a country, the same steps as for downloading an XML file can still be followed in this dialogue. The difference to countries with XML function is that these forms can only be downloaded as a PDF-file in each case. However, steps 2 (export of declaration for sending) and 3 (mark declaration as sent) in particular are also available here and are important so that the change in status of the company can be documented and tracked.

Additional steps in dispatch

Regardless of the degree of automation during dispatch, additional functions can always be configured per country via the dialogue [Settings → Countries].

Review before/after Transfer

If the review before or after transfer is configured, it can be carried out not only in the Month Overview dialogue but also in the Send declaration dialogue.

If the review before transfer is configured, this step is placed before the step [Export declaration for sending] or [Send declaration via web service (productive)] and must be ticked off so that the following step can be carried out.

The review after transfer can only be set after a declaration is considered to be transmitted and is therefore placed after [Mark declaration as sent] or [Send declaration via web service (productive)].

Compared to the Month Overview dialogue, the Send Declaration dialogue has another review function, which, however, must be configured additionally. For both review variants, it is possible to document the review by uploading a document.

Upload voucher

If the VAT return has been sent successfully, a payment document can be saved in the VAT@GTC. This function requires the corresponding settings in the Master Data.

Transmission Protocol

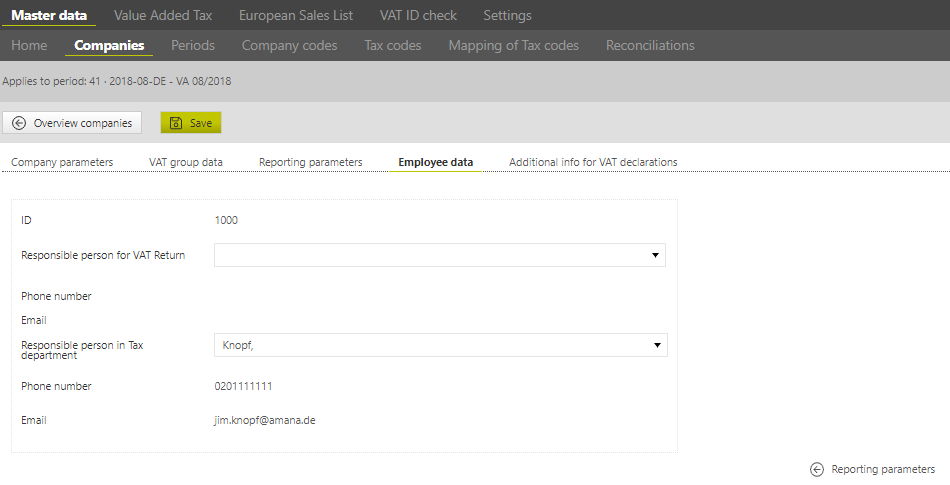

Example: Header of a Test Transfer Log

The transmitting company will always be issued as the transmitter and, if indicated, the data of the person in charge of the tax department.

This must be specified under [Master data] - [Companies] - [Employee data].

To use the payment voucher function, this must be enabled in the country settings. If this step is configured, it is the last step in the Send Declaration dialogue.