...

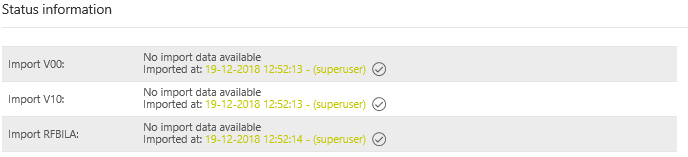

The [Status Information] is used to display the imported reports V00, V10 and RFBILA. The respective report shows whether an import has been carried out, when and by which user.

Import of reports

The reports can be imported manually, via a network drive (and fallback) or via the web service. The import method used in the VAT@GTC is mostly defined at the beginning of the Project.

Manualimport

If the data are imported manually, select a report using the dropdown and the upload a locally saved document using the [Browse] button.

...

If the VAT@GTC recognises the available reports, they appear in the overview. Use the [New import data are available] to import the available reports into the VAT@GTC.

Fallback Import

If the network drive is temporarily not available, the [Fallback Import] option can be used. Select the report type, find it on the local computer and click [Import].

...

The import can also be unsuccessful. If any errors occur, an error message is displayed in the upper area of the [Import] dialogue. The following messages can be displayed:

| Company Code does not match with the Company code from the selected import file! | This error message means that the company code in the report does not match the company code in the [Company code] dialogue of the [Master data] main area. |

| Period in ERP Report does not match the selected one! | This error message is shown if the date in the report does not match the selected period. |

| No file selected. | No report has been selected. |

| There is no headerline with valid date informations | With this error message, the date format of the SAP report is not specified correctly. |

Report Selection

Imported data

...

If the import has been carried out successfully, the signs are adjusted as follows:

| Sign in report | Adjustment of the sign during the import | The sign in the VAT@GTC | |

|---|---|---|---|

| MWS/ESA | - | - | + |

| VST/ESE | + | + | + |

In some SAP systems, however, it is possible that the signs in RFUMSV00 are set differently. With the standard setting, the following may happen, for example:

| Sign in report | Adjustment of the sign during the import | The sign in the VAT@GTC | |

|---|---|---|---|

| MWS/ESA | + | - | - |

| VST/ESE | - | + | - |

If the signs of the tax base and tax are different, a coordination with AMANA must be carried out and parameters must be adapted in the master data area (special case).

...

Copy the values to the VAT return

| Tabs | ||

|---|---|---|

|

...

| |||

[{"content":{"version":1,"type":"doc","content":[{"type":"paragraph","content":[{"type":"text","text":"To copy the values from the import correctly, a tax code mapping must be performed. "}]},{"type":"paragraph","content":[{"type":"text","text":"When transferring the values to the report, there is an option to keep or discard manual entries already made."}]}]},"id":"5a069d26-7ed2-4049-9ce3-2b858d426552","label":"Version 23.0-23.16","type":"tab"},{"content":{"version":1,"type":"doc","content":[{"type":"paragraph","content":[{"type":"text","text":"To copy the values from the import correctly, a tax code mapping must be performed. "}]},{"type":"paragraph","content":[{"type":"text","text":"When transferring the values to the report, there is an option to keep or discard manual entries already made."}]},{"type":"paragraph","content":[{"type":"text","text":"If the [Additive import] option is enabled for the company, it is also possible to decide whether values that have already been imported should be retained or overwritten."}]}]},"id":"6c68625d-2296-4148-8df4-fcf64f82aad3","label":"Since Version 23.17","type":"tab"}] |

Report RFUMSV10

The original report and the overview table in the VAT@GTC can be seen in the following figure [Import process RFUMSV10]. The columns from [Company report]. The columns from [BuKr] to the [Currency] column are displayed in the overview table in the same way as in the report.

...

The signs for active/expense accounts from the current movement balance are copied into VAT@GTC, since in SAP it is usually debited to the account. And since the liabilities/revenue accounts from the current movement balance are usually credited in SAP, the system reverses the signs.

Sign in report | Adjustment of the sign in the VAT@GTC | The sign in the VAT@GTC | |

|---|---|---|---|

| liabilities/revenue accounts | - | Yes | + |

| Active/expense accounts | + | No | + |

Warnings

If an account is not saved in the master data, this is indicated by a [Warning]. Nevertheless, import is possible. The accounts that are marked with a [Warning] are not imported.

| Warning | Explanation |

|---|---|

| Value not imported, because G/L account is not maintained in Master data. Therefore value will not be available in Reconciliation. | If such warning is displayed, it is recommended to check whether this account has been newly added to SAP and if so, add it to the master data. |

| The specified account has already been imported. | If the message is given that an account has already been imported, this account will be listed twice in the RFBILA. |