...

In the reconciliation table, there are mainly columns that refer directly to RFUMSV00 and calculated columns:

| These fields are all filled directly from the import of the RFUMSV00 and thus mirror the RFUMSV00. | |||||

| Calculated tax (base) | The calculated Tax base is determined from the tax rate and the tax value. The calculated tax value is determined from the tax rate and Tax base. Resubmissions and automatic reconciliation 1 adjustments are already included in these columns. This column is also updated for manual adjustments. | |||||

| Initial difference base /tax | These columns show the difference between the Tax base (or tax) in RFUMSV00 and the Tax base (tax) calculated from RFUMSV00. In these columns only the RFUMSV00 is considered, no further changes in the VAT@GTC.

|

Functionality

The functionality of the reconciliation is explained below using examples. In the example we use a tax code with the tax rate 19%:

Example 1 (No error):

Check | Values from the RFUMSV00 | Calculation in VAT@GTC: | Difference | Result |

|---|---|---|---|---|

Tax base | 190 € | 1.000 € x 19 % = 190 € | 0€ | This reconciliation position is without error. |

| Assessment base | 1.000 € | 190 € / 0,19 = 1000 € | The status is marked with a tick and no editing is necessary. |

Example 2 (Error)

Check | Values from the RFUMSV00 | Calculation in VAT@GTC: | Difference | Result |

|---|---|---|---|---|

Tax base | 50 € | 1.000 € x 19 % = 190 € | 140€ | This reconciliation position has an error that requires manual intervention. |

| Assessment base | 1.000 € | 50 € / 0,19 = 263 € | 737€ | The reconciliation status is shown my X. Editing of the reconciliation position is initiated via the checkbox in the [Edit] column. |

For reconciliation 1, it is possible to configure a limit for automatic adjustments per company. For this, it must be configured system-wide whether the tax or the tax base is to be adjusted in the case of an automatic adjustment. The limit then refers to the side that is to be automatically adjusted.

...

Example 3 (Limit for automatic adjustments)

Check | Values from the RFUMSV00 | Calculation in VAT@GTC | Difference | Limit for automatic adjustments | Automatic adjustments of the | Result |

|---|---|---|---|---|---|---|

Tax base | 189 € | 1.000 € x 19 % = | 1€ | 5€ | tax | The deviation is below the limit for automatic adjustments. At the time of import, the tax is corrected by 1€ and added to the declaration. In the columns [Calculated Tax base / Tax] this automatic adjustment is already taken into account. The column [Initital difference Tax base / Tax] still shows a difference. In the column Reconciliation Result an exclamation mark and no tick is deposited. Editing is not necessary as this was done automatically. |

| Assessment base | 1.000 € | 185 € / 0,19 = 994,73€ | 5,27€ | 5€ | tax base | The deviation is above the limit for automatic adjustments and therefore has an error. Therefore, no automatic adjustment is made, requiring manual intervention. The reconciliation status is represented by an X. Editing of the reconciliation position is initiated via the checkbox in the [Edit] column. |

| Tip | ||

|---|---|---|

| ||

If resubmissions are activated, resubmissions are also created for automatic adjustments. The VAT_RECON1_RESUB_LIMIT flag can be activated to automatically set resubmissions from automatic adjustments to completed. |

...

This reconciliation requires a separate G/L account for VAT to pay or recover. The amount to pay or recover calculated in the VAT return is compared to the balance of the account for VAT to pay or recover from the RFBILA, which has been imported for the current month.

Reconciliation table

| These columns describe the G/L account for VAT to pay or recover that is compared with the calculated tax. |

| Amounts from RFBILA | This column shows the value posted to the account for VAT to pay or recover in this month. Manual changes to the account for VAT to pay or recover entered in VAT@GTC are included here. |

| Amounts from tax codes | This column shows the calculated tax value from the declaration. For this purpose, the value is taken directly from the field VAT advance payment/surplus in the declaration. |

| Difference | In this column, the difference between the calculated tax and the booked tax is drawn. If this value is higher than the tolerance limit configured for this reconciliation, reconciliation 2 is incorrect. |

The amounts often do not match in this reconciliation. Reasons for this can be:

...

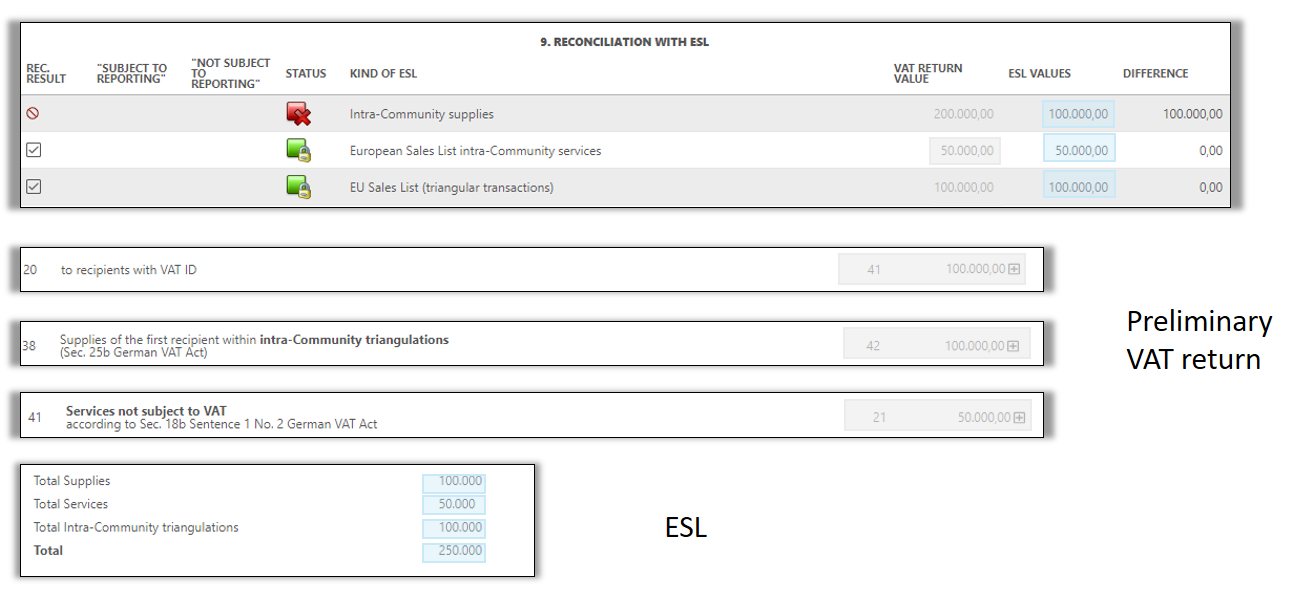

The aim of the reconciliation 9 is to identify whether the reported values in the ESL match to the values in the monthly VAT return. In order to perform this reconciliation in the VAT@GTC the amounts reported in the ESL are needed.

The values from the VAT return are included in the reconciliation on the basis of the relevant fields. Based on the form field allocation, the VAT@GTC differentiates between intra-Community supplies (field 41), as well as supplies of agricultural and forestry businesses according to § 24 UStG to customers with a VAT ID number (field 77), non-taxable other services (field 21) and intra-Community triangular transactions (field 42). The values from the ESL are added up per type.

| Type of transaction | ||

|---|---|---|

| Intra-Comunity Supplies | Field 41 + Field 77 | All Entries with type of transaction "0" - Supplies- summed up |

| Intra-Comunity Services | Field 21 | All Entries with type of transaction "1" - Services - summed up |

| Intra-Comunity triangulations | Field 42 | All Entries with type of transaction "2" - triangulations - summed up |

In the master data, you can set whether the reconciliation is to be carried out when the advance return for VAT is created or when the recapitulative statement is created, or in both declarations.

...

If certain tolerance limits are not exceeded in these two reconciliations, the user has the choice to ignore the difference or take this resubmission into the next period, where it can be checked again.

Option to hide zero values in RFUMSV10 and RFBILA

In the area of reconciliations (master data), the option to hide zero values from the reports can be switched on and off for reconciliations 3 to 5. The option must be selected separately for the report RFUMSV10 as well as for RFBILA. By switching on the option, the result of the respective voting is slimmed down so that rows without values are no longer displayed.